Quote of the day

Tim Richards, “The reality is that people are reflexive and markets are adaptive.” (The Psy-Fi Blog)

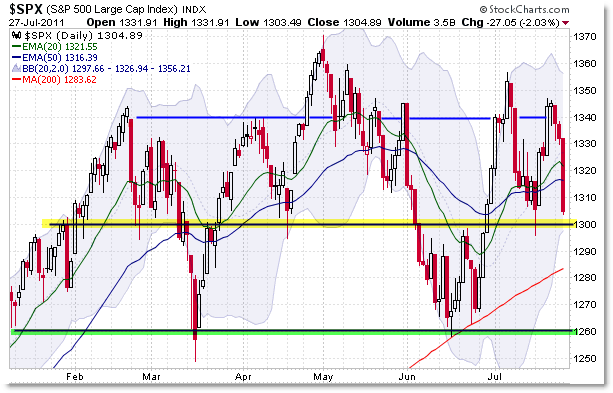

Chart of the day

Levels matter more than moving averages in a rangebound market. (Afraid to Trade)

Markets

Market volatility is picking up ever so slightly. (Bespoke)

Testing comparable moving average lengths. (CXO Advisory Group)

Nearly half of US corporate cash balances are held overseas. (FT)

Canada as a refuge from the storm. (Humble Student)

Wal-Mart ($WMT) as the new risk-free rate. (MarketBeat)

Strategy

The amazing spread in returns between the returns to a high profile mutual fund and actual investor returns. (Morningstar)

There are only two reasons for long-dated, illiquid assets. (Aleph Blog)

On the dangers of “confirmation bias and shallow analysis.” (Economic Musings)

Nine mistakes investors make. (WealthFront)

Technology

How to fix Microsoft ($MSFT). (SAI)

HTML5 could put the hurt on Adobe ($ADBE) Flash. (GigaOM)

The much hyped Verizon ($VZ) iPhone was swamped by overseas growth. (Asymco)

Three companies Google ($GOOG) should buy. (TechInsidr)

Howard Lindzon, “Amazon ($AMZN) CANNOT be valued. Not in a bad way either.” (Howard Lindzon)

Sprint ($S) cannot seem to get out of its own way. (MarketBeat, Insider Monkey)

Companies

Average performance at ConocoPhilips ($COP), handsome rewards. (footnoted)

Green Mountain Coffee ($GMCR) shows a growing gap between earnings and FCF. (research puzzle pix)

It helps to have a brand name when launching an IPO. The case of Dunkin’ Brands ($DNKN), (Dealbook)

Three retailers that could go the way of Borders. (Marketwatch)

Fast food IPOs do not necessarily run right out of the gate. (YCharts)

Finance

Goldman Sachs ($GS) is big in the aluminum warehouse business. (Reuters)

The big banks are not best in class in any of their business lines and the market knows it. (Dealbook)

The slicing and dicing of sector ETFs gets ever thinner. (Random Roger, IndexUniverse)

Harry Markopolos is happy with the new SEC tip line. (Reuters)

The National Science Foundation is embracing the startup culture. (peHUB)

Global

Sovereign credit default swaps: what are they good for? (WSJ)

Europe’s debt crisis is far from over. (Curious Capitalist)

Brazil really wants to tamp down on speculation in the real. (Reuters)

High coffee bean prices may not last indefinitely. (FT)

Economy

A very small sign of hope on the unemployment front. (Calculated Risk, Capital Spectator, Economist’s View)

A downgrade of the US is a long term negative for the economy. (Musings on Markets, Felix Salmon)

Econobloggers are gloomy on the economy. (Capital Spectator)

Jonah Lehrer, “If trust begins when we share the treasure, what happens when there’s no treasure left to share?” (The Frontal Cortex)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

The economics of letter restaurant grades. (Felix Salmon)

The ugly financial picture at Forbes Media. (Fortune)

Important changes for StockTwits users. (Howard Lindzon)

Abnormal Returns is a founding member of the StockTwits Blog Network.