Quote of the day

“Good returns derived from uncomfortable strategies do not get arbitraged away, because very few people will actually do it. ” (Systematic Relative Strength)

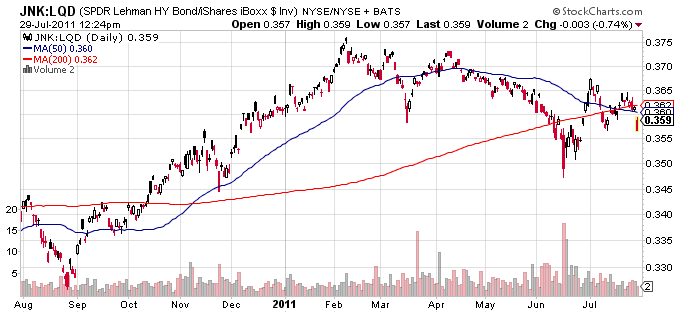

Chart of the day

High yield bonds have been underperforming for some time now. (Minyanville)

Markets

The dog days of August: historical seasonal performance. (MarketSci Blog, ibid)

Corporate insiders are dumping shares with abandon. (Marketwatch)

More on the ‘no risk-free asset‘ meme. (FT Alphaville)

Strategy

Comparing low volatility equity ETFs including the PowerShares S&P 500 Low Volatility ($SPVL). (IndexUniverse)

Buy-writes on a daily time scale. (Dragonfly Capital)

Thinking about a novel collar strategy. (StockTwits U)

Dinosaur Trader asks whether stock trading ruining your memory? (The Reformed Broker)

It’s no longer a turnaround at Starbucks ($SBUX), it is a full-blown expansion. (Bloomberg, 24/7 Wall St.)

Technology

Signs for spotting a Web 2.0 bubble top. (The Reformed Broker)

Why Amazon ($AMZN) should buy Hulu. (ReadWriteWeb)

Google ($GOOG) arms itself for the software patent wars. (Bloomberg)

How the patent wars could end…with a Supreme Court ruling. (SAI)

Hedge funds

The SEC is cracking down on what a ‘family office‘ covers. (Dealbreaker also All About Alpha)

Small hedge funds are partnering up out of desperation. (Bloomberg)

Why hedge funds are turning inward. (Minyanville)

Finance

Traders are jumping ship at Goldman Sachs ($GS). Is the Age of Goldman over? (Clusterstock also Reuters)

The Corzine touch is apparently working at MF Global ($MF). (WSJ)

Mortgage REITs are getting hit on fears about the repo market. (Bloomberg)

Genworth Financial ($GNW) is embracing the spinoff theme. (Deal Journal)

Global

What say the Big Mac Index about the Chinese yuan? (Economist)

China’s yield curve is flattening. (Credit Writedowns)

Australia vs. the US: comparing P/E ratios. (Macrobusiness)

On the prospects for a global currency. (HBR)

Economy

First half GDP grew much slower than expected. (WSJ, Calculated Risk, Econbrowser, Crossing Wall Street, Capital Spectator, Free exchange, Credit Writedowns, EconomPic Data)

Who knew calculating GDP was so difficult? (Bespoke)

When might the output gap close? (macroblog)

Is the war on earmarks a reason for our current debt deadlock? (Megan McArdle)

Earlier on Abnormal Returns

What you missed in our debt ceiling-focused Friday linkfest. (Abnormal Returns)

Mixed media

Your brain on equities. It is not a pretty picture. (Big Picture)

Abnormal Returns is a founding member of the StockTwits Blog Network.