Quote of the day

Barry Ritholtz, “Alas, this bull cycle, after a screaming move higher, is starting to look tired.” (Big Picture)

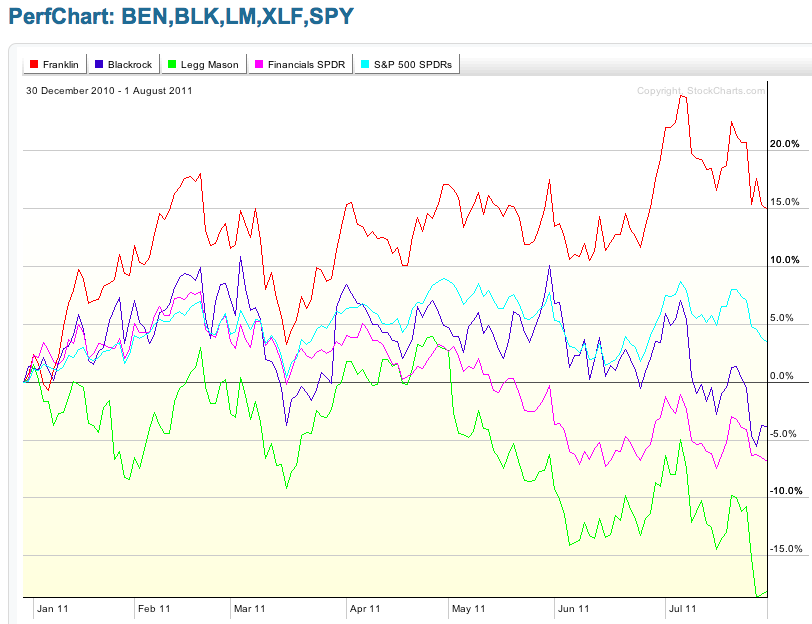

Chart of the day

Franklin Resources ($BEN) is the belle of the money management ball. (InvestmentNews, Focus on Funds)

Markets

Sometimes you have to leave the party a little early. (The Reformed Broker)

Tough times for bond bears. (Tyler’s Trading)

Muni bonds are getting a pop off of the debt deal. (MarketBeat)

At least commodity pressures are easing. (Bespoke)

Strategy

Why you need a margin of safety when investing. (Aleph Blog)

How to use the Fama-French model. (Empirical Finance Blog)

On the importance of routine to trading. (Kirk Report)

You gotta have a plan when trading/investing. (Economic Musings)

Dividend focused funds are becoming more adventuresome. (WSJ)

Companies

Ford ($F) may now be facing the downside of not going bankrupt. (Fortune)

Netflix ($NFLX) has consistently surprised the Street. (research puzzle pix)

The mobile payments space is a mess. (SplatF)

Global

Italy and Spain are under renewed pressure. (Credit Writedowns, NYTimes, Bespoke)

Why you should sell commodities, the emerging markets are pulling back. (Pragmatic Capitalism)

Economy

The most dangerous economists in the world today don’t come across as so. (Money Game)

The austerity imposed from the budget deal will not all hit in 2012. (Pragmatic Capitalism also Macroadvisers)

If the US loses its AAA rating it will never get it back. (Felix Salmon, Term Sheet)

Right now the economic data is not supportive of dynamic economic growth. (Tim Duy)

The US needs “economic velocity” not austerity. (Bonddad Blog)

Don’t count on the Fed to offset any short-term fiscal contraction. (Free exchange)

Help wanted ads are dropping unexpectedly. (Economix)

Punk personal income and spending in July. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

What it means to be a ‘first mover.’ (Feld Thoughts)

How would you realign Major League Baseball? (Freakonomics)

Abnormal Returns is a founding member of the StockTwits Blog Network.