Quote of the day

Mike Bellafiore, “Not only must you pay a tuition to the market to begin as a trader but there will always be a cost for your continuing education.” (SMB Training)

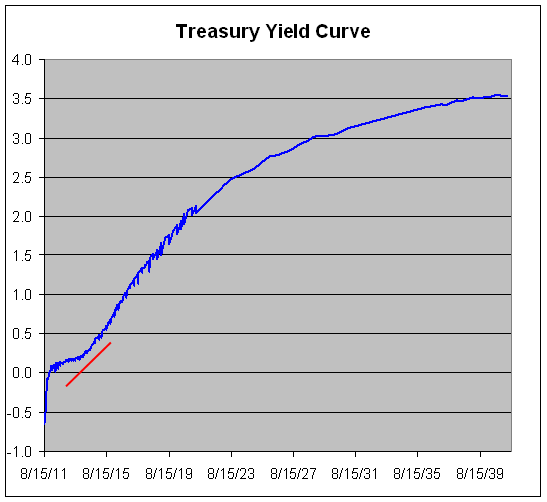

Chart of the day

The yield curve now has a prominent “notch.” (Crossing Wall Street)

Markets

More looks at the surge in market volatility. (Afraid to Trade, Crossing Wall Street)

A long term look at the platinum/gold ratio. (Bespoke)

A look at sector P/E ratios. (Dr. Ed’s Blog)

Large cap dividend payers vs. Treasuries. (Bonddad Blog)

Strategy

Warren Buffett is issuing bonds and buying stocks. (Fortune)

The stock market is pricing in bad news for earnings and the economy. (macrofugue, TRB)

Sell TIPs, buy emerging market equities: the case for rebalancing. (Capital Spectator)

How to play an oversold relief rally. (Humble Student of the Markets)

Josh Brown, “Not all insider buying is created equal.” (The Reformed Broker)

How did the “new normal” turn out for investors? (I Heart Wall Street)

On the the options pinning myth. (Attitrade)

Five signs your financial advisor sucks. (Wealthfront)

Research

What asset classes tend outperform when real interest rates are negative. (World Beta)

Stop loss orders are short volatility, especially in this environment. (Bigger Capital)

How “displacement risk” explains the growth stock premium. (Empirical Finance Blog)

HFT adds liquidity, until it doesn’t. (The Physics of Finance)

Companies

Intel ($INTC) wants everyone to have an ultrathin laptop. (SAI)

AMR ($AMR) joins the spinoff wave. (WSJ)

AOL ($AOL) is instituting a big stock buyback. (TechCrunch, Dealbook)

How much of an iPhone is made by Samsung? (Economist)

Is Jeff Bezos underrated? (24/7 Wall St.)

How can you not hope BankSimple succeeds? (GigaOM)

Hedge funds

Black swan funds have their day in the sun. (Felix Salmon)

Unlike 2008, hedge funds have avoided much of the blame for the market’s current woes. (All About Alpha)

Finance

How super-low interest rates hurt banks. (WSJ)

A decade from now banks will be smaller, less profitable and have fewer employees. (FT)

The story has not been written about muni bond ratings. (Fortune)

Global

Swiss interest rates go negative. (FT Alphaville)

Emerging and developed market sovereign credit ratings should converge over time. (FT Tilt)

China’s economic slowdown seems to be slowing down. (Data Diary)

China needs to rebalance its economy away from investment. (WSJ)

Demand for oil is evaporating. (The Source)

Economy

Corporate America is flush with cash, but is unwilling to put it to work. (WSJ)

David Merkel, “If you are not a critic of neoclassical economics, particularly after the 2008 crash, you aren’t thinking. ” (Aleph Blog)

Fear is creating its own economic reality. (A Dash of Insight)

If there is no Bernanke Put, then markets need to stand on their own legs. (Free exchange)

You can’t have deflation without a big dose of discouragement. (Pragmatic Capitalism)

Hope springs eternal for further quantitative easing. (FT Alphaville)

Weekly unemployment claims dip below 400,000. (Calculated Risk, CBS Moneywatch)

The June trade deficit numbers don’t augur well for economic growth. (Atlantic Business)

The case for continued economic growth. (Modeled Behavior)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Media

Pundits are not necessarily motivated by the truth. (Big Picture)

Does blogging help the careers of professional economists? (Marginal Revolution)

You can’t do anything about the weather, but at least you can tweet about it. (GigaOM)

In praise of physical media. (Technologizer)

Mixed media

Finally some good news. A new drug that targets all viruses. (MITnews via @fmanjoo)

A profile of environmentalist Jeremy Grantham. (NYTimes)

A positive review of Jeff Matthews’ new book on Warren Buffett. (Aleph Blog)

Introducing The Black Cod Index. (FT Alphaville)

Abnormal Returns is a founding member of the StockTwits Blog Network.