After a long week we are taking off a bit early this summer Friday. We hope you enjoy the linkfest.

Quote of the day

John Hempton, “Being wrong and losing money: that is part of the game. Being right and not making money: that is really annoying.” (Bronte Capital)

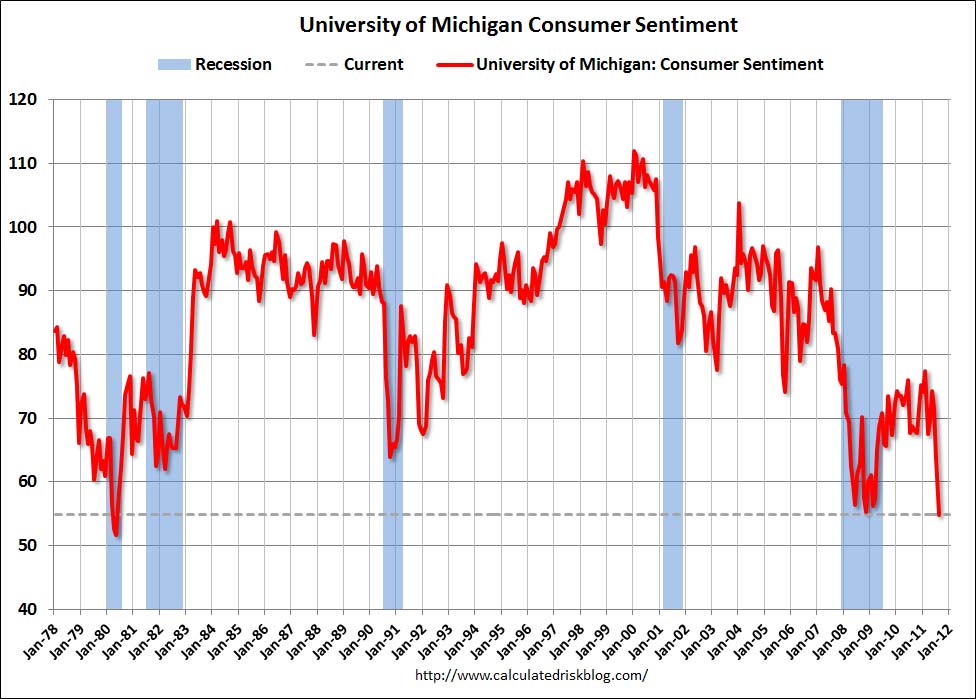

Chart of the day

Consumer sentiment plunges. (Calculated Risk, Real Time Economics)

Markets

Welcome to the Bipolar Market. (Big Picture)

High yield bond spreads have widened back out to 2010 levels. (Bespoke)

Comparing the yield on the S&P 500 vs. Treasury yields. (Kid Dynamite)

Ten-year TIPS yield 0%. (Crossing Wall Street)

The first year for the United States Commodity Index ($USCI). (ETFdb)

Strategy

Valuation models: fun with data mining. (World Beta)

Communication is a two-way street for clients and advisers. (I Heart Wall Street)

The challenge of paradigm shifts in valuation. (Systematic Relative Strength)

Companies

Would you put your money in the Bank of Microsoft ($MSFT)? (Breakout Performance)

How can the Angry Birds stay angry at a $1.2 billion valuation? (Bloomberg)

Eight utilities with attractive dividend yields. (YCharts)

Hedge funds

Niche hedge fund of funds are “in vogue.” (Dealbook)

Making the case that too much capital lead to John Paulson’s poor performance in 2011. (Reuters)

Finance

Short sale bans simply don’t work. (MarketBeat, FT)

Why are institutional cash managers so willing to hold T-bills with zero yield? (FT)

Looks like we are going to have to live with HFT. (Freakonomics)

The SEC wants to know if knowledge of the USA downgrade leaked out. (FT)

The ratings agencies have not done a good job historically identifying beforehand sovereign defaults. (WSJ)

Global

If European banks need to be bailed out, who would pay? (NYTimes)

How the Swiss franc could lose its safe haven status. (beyondbrics)

How is fiscal austerity working out for the UK? (Econbrowser)

How to read a strengthening Yuan. (Bloomberg)

Economy

Retail sales came in better than expected. (Calculated Risk, Capital Spectator)

The case for inflation. (NYTimes)

Why Treasury bonds continue to attract interest. (NetNet)

How markets can affect recession forecasts. (Fortune)

What are the chances the “super committee” gets a deal done? (A Dash of Insight)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Trying to find the equivalent in Moneyball in soccer is harder than it looks. (WSJ)

Abnormal Returns is a founding member of the StockTwits Blog Network.