Quote of the day

Jeff Matthews, “Sounds like Warren Buffett is getting worried.” (Jeff Matthews Is Not Making This Up)

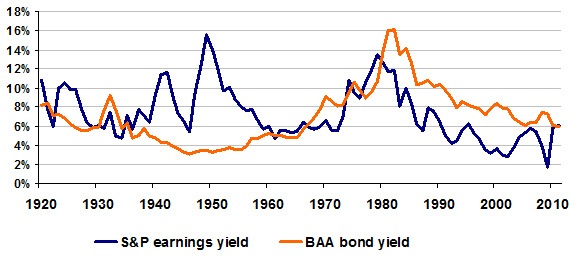

Chart of the day

Earnings yields vs. Baa yields vs. Treasury yields: which is more appropriate? (Felix Salmon)

Markets

Past as prologue. Japan vs. the USA. (Big Picture)

The materials sector looked best last week. (Dragonfly Capital)

The investment grade bond window is still wide open. (MarketBeat)

Emerging market equities look cheap. (beyondbrics)

Strategy

Mean reversion trades can work so long as the risk is well defined. (Stock Sage)

The rich appear to have pulled back their equity exposure. (WSJ)

Spread trade of the day: $XOM vs. $CVX. (Dynamic Hedge)

Why calendar spreads work in this environment. (Investing With Options)

The argument that we have not yet reached a sustainable bottom. (Value Restoration Project)

Behavior

Investor misconceptions about risky stocks. (Falkenblog)

Portfolio rebalancing has its detractors. (Capital Spectator)

Most people don’t (and shouldn’t) trade their portfolios. (Morningstar)

Michael Mauboussin on why you should pay attention to your decision making environment. (Big Think)

Companies

US industrial companies are hunkering down for tougher economic times. (FT)

Can Microsoft ($MSFT) thrive in a post-PC world? (WSJ)

Why can’t other companies compete against the iPad or Macbook Air? (Apple 2.0)

Google-Motorola Mobility

The ultimate Google-Motorola Mobility linkfest. (Abnormal Returns)

Don’t worry about Motorola Mobility executives, they will be just fine. (footnoted)

Shorting is a bloodsport. (The Reformed Broker)

The death of the M&A scoop. (Felix Salmon)

Finance

A private equity fund focused on buying stakes in hedge fund firms. (peHUB)

Are your emerging market ETFs missing out on these markets? (IndexUniverse)

Global

Can Asian currencies serve as a safe haven. (WSJ)

George Soros says Eurobonds are an inevitability. (Pragmatic Capitalism, The Source)

The SNB would regret pegging the Franc to the Euro. (The Source)

Japan’s economy grew faster than expected in Q2. (Reuters)

On the mutually beneficial relationship between China and the US. (Pragmatic Capitalism)

Sino-Forest reported earnings. (FT Alphaville)

Economy

The Bloomberg Business Conditions Index has rolled over decisively. (Pragmatic Capitalism)

Even with 9% unemployment Americans can’t seem to show up to work on time. (Money Game)

How long it takes for consumer sentiment to bounce back from an external event. (Calculated Risk)

QE3 has already started. (Credit Writedowns)

Warren Buffett wants his taxes raised. (NYTimes also Business Insider, TRB, Points and Figures)

Want a stronger dollar? Raise taxes. (Money Game)

Americans continue to remodel their homes. (Calculated Risk)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Billionaires invest differently than the rest of us, so why do we heed their advice? (Abnormal Returns)

Individual investors are notoriously poor market timers, but the mutual fund industry keeps serving up volatile offerings. (Abnormal Returns)

Mixed media

The differences between the NY Times and FT paywalls. (Felix Salmon)

Abnormal Returns is a founding member of the StockTwits Blog Network.