Quote of the day

Henry Blodget, “Does Groupon have enough cash to make it to its IPO?” (SAI, ibid)

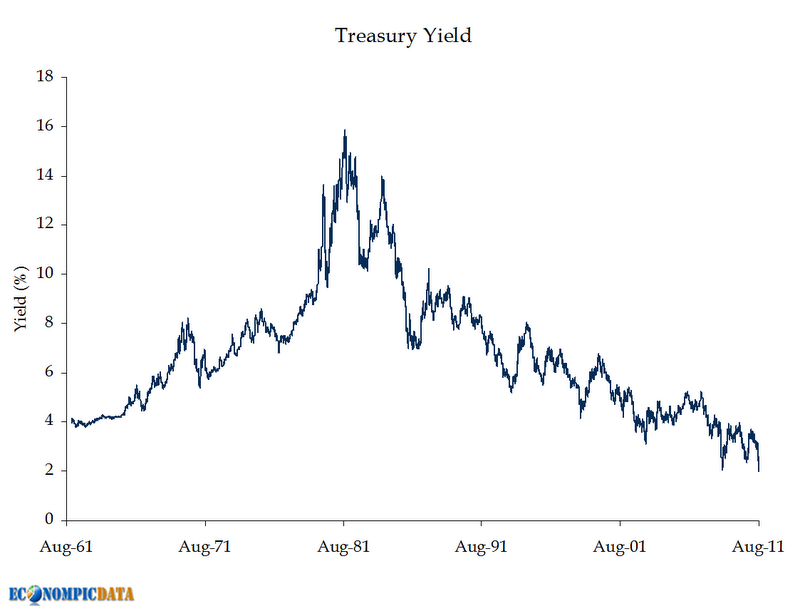

Chart of the day

Putting current yields into some historical perspective. (EconomPic Data also MarketBeat)

Markets

Bottoms take time and most stocks have not yet built solid bases. (stockbee)

Earnings matter. What are the odds of a collapse in earnings? (Money Game)

Stocks are pricing in slow growth, not a full-blow recession. (Humble Student of the Markets)

The spike in oil volatility is enticing. (Tyler’s Trading)

Midwest farmland prices are on fire. (Big Picture Agriculture)

Strategy

Resisting the urge to nibble. (The Reformed Broker)

The trouble with averages. (Derek Hernquist)

How asset price bubbles can have such a pernicious effect on the real economy. (voxEU)

Companies

Hewlett-Packard ($HPQ) joins the spinoff parade. (Bloomberg)

Does Google ($GOOG) have Cupertino envy? (AllThingsD, Apple 2.0, TechCrunch)

Can Google fix the cable box? Not likely. (Slate)

The #2 spot in tablets is still wide open…hello Microsoft ($MSFT). (SplatF)

The sad state of affairs at Kodak ($EK) now includes a patent fire sale. (The Tech Trade)

ETFs

A look at some non-core bond ETFs. (ETFdb)

Don’t forget that the iPath S&P 500 VIX Short-Term Futures ETN ($VXX) is for short-term traders only. (IndexUniverse)

There is an ‘engineered ETF‘ for just about every market environment these days. (research puzzle pix)

Finance

Shareholders in private equity managers prefer management fees over carried interest. (Dealbreaker)

News flash: LTCM was overleveraged. (FINalternatives)

Some municipalities have seen their credit ratings hit with “superdowngrades.” (WSJ also Mark Thoma, Business Insider)

Everybody was trading oil futures back in 2008. (WSJ)

China

The Chinese stock market has been underperforming the S&P 500 for awhile. (StockCharts)

Is the Chinese stock market finally cheap? (MarketBeat)

China’s options when it comes to US Treasuries are limited. (FT Alphaville)

Europe

The Fed is keeping a close eye on the US branches of European banks. (WSJ)

How is it that France has avoided a downgrade? (Slate)

Since when did the Pound become a safe haven currency? (The Source)

How Eurobonds might work. (Pragmatic Capitalism)

Negative Swiss Libor rates may not be far off. (MarketBeat, ibid)

Economy

Is inflation finally back? (Felix Salmon also Carpe Diem, CBP)

The Philly Fed report was a “total disaster.” (Pragmatic Capitalism, Modeled Behavior, Calculated Risk)

Initial claims have settled into the 400,000 range for the time being. (Calculated Risk)

Once unthinkable now negative interest rates are a reality. (Reuters)

Texas avoided the housing bubble and the subsequent deleveraging. (Rortybomb)

Earlier on Abnormal Returns

A look at the short and long term prospect for gold prices. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

Does marijuana make you stupid? (The Frontal Cortex)

Abnormal Returns is a founding member of the StockTwits Blog Network.