Quote of the day

Tsachy Mishal, “Taking a large loss is one of the most painful things for me in investing but I knew I had to do it…I feel slightly better about my HP loss today.” (Capital Observer)

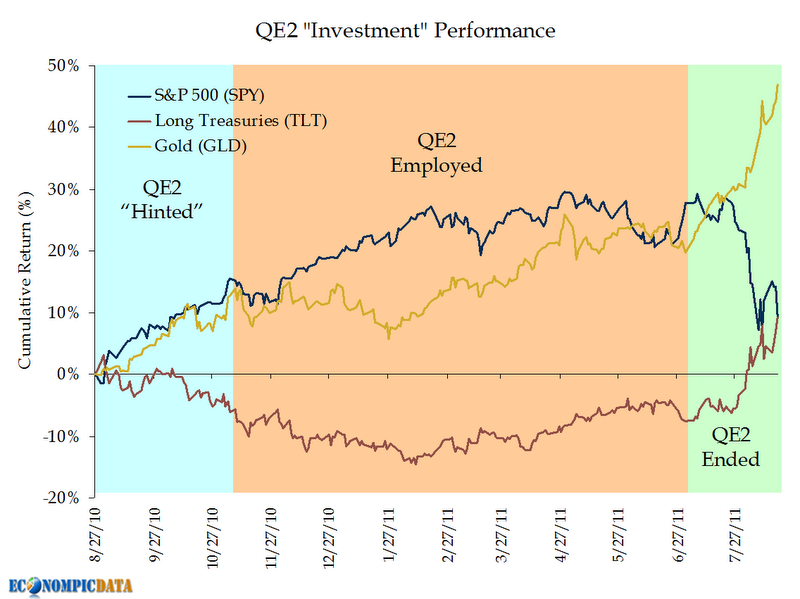

Chart of the day

The market’s reaction to QE2. (EconomPic Data also Quantifiable Edges)

Markets

Silver and gold: risk on/risk off. (Market Anthropology)

Echo volatility: the return of the VIX to recent highs. (VIX and More)

The “correlation bubble” is in no danger of bursting any time soon. (Felix Salmon)

Tracking the long term relationship between Treasury yields and the S&P 500. (Afraid to Trade)

Muni bonds have largely shrugged off the USA downgrade. (Bloomberg)

Share buybacks are surging. (FT)

Is volume overrated? (Tyler’s Trading)

Strategy

Ten rules for surviving a market crash. (The Reformed Broke)

Once more with feeling: bottoming is a messy process. (Mark Hulbert)

Stocks and bonds: looking eight years out. (EconomPic Data)

A closer look at the St. Louis Fed Stress Index as a equity market indicator. (A Dash of Insight)

Mark Cuban is a Keynesian when it comes to investing. (Falkenblog)

Companies

John Malone will take any part of Barnes & Noble ($BKS) he can get. (WSJ, Dealbook)

Google ($GOOG) is making a big bet the Motorola Mobility ($MMI) deal will close. (Dealbook)

iPad 3 is coming in 2012. (WSJ)

At IPO time the Carlyle Group wants to be compared to the Blackstone Group ($BX). (Term Sheet also WSJ)

Finance

This story is sad, but all too common. Where is the SEC? (NYTimes)

A disturbing inside look at Moody’s ($MCO). (Business Insider)

If dual-class share systems don’t make sense, why do people keep buying them? (WSJ)

Asset managers

The asset management industry has lost its way and their stocks are suffering. (research puzzle pix)

Buy and hold is what mutual fund mangers want you to do, not necessarily what they do. (CBS Moneywatch)

Institutional investors are falling out of love with dark pools. (Economist)

Hedge funds

“August is on track to be one of hedge funds’ worst months ever. ” (Economist)

Not every hedge fund is getting crushed this month. (Big Picture)

In August investors seem to be sticking with their hedge fund investments. (HedgeWorld)

Moving prop trading from banks to hedge funds is a positive trend. (FT)

How good a job do hedge fund of funds do at diversification? (All About Alpha)

Index funds

Why the SEC shouldn’t push index funds on investors. (Felix Salmon)

On the difference between a good index fund and a “polluted” index fund. (Forbes)

How the Maxis Nikkei 225 ETF ($NKY) came to market. (IndexUniverse)

Economy

Time to refinance: mortgage rates are at 50-year lows. (Big Picture, Carpe Diem)

The last string to push on: mortgages. (Economic Musings, Free exchange)

Medium-term inflation expectations are falling. (Free exchange)

A look at a handful of inflation measures. (Calculated Risk)

The ECRI WLI just went negative. (MarketBeat)

Tax expenditures matter. (Econbrowser)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Check out our ultimate Hewlett-Packard ($HPQ)-Autonomy linkfest. (Abnormal Returns)

Mixed media

On the disruption of the console gaming business by casual online games. (Chris Dixon)

Who is Zero Hedge, and why should we care? (Streetwise Blog)

Abnormal Returns is a founding member of the StockTwits Blog Network.