Quote of the day

TR, “Volatility is simply the outward sign of humanity’s inveterate psychological weaknesses.” (The Psy-Fi Blog)

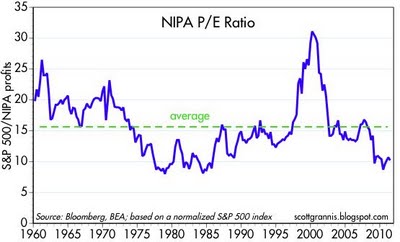

Chart of the day

Investors are unwilling to pay up for current record corporate profits. (Calafia Beach Pundit)

Markets

The percentage of stocks of above their 20/50/200 day moving averages. (All Start Charts)

The “dumb money” is still bearish. (The Technical Take)

The degree of gold bullishness is surprising. (Kid Dynamite)

Why the stock market of late seems to rally on Tuesdays. (Crossing Wall Street)

A safe haven isn’t all that safe if it is overvalued. (WSJ)

The markets are “braced” for higher volatility. (macrofugue)

Corporate bonds are lagging Treasuries. (Afraid to Trade)

Strategy

Don’t let the ‘halo effect‘ prevent you from doing real company analysis. (WSJ)

Options strategies for investors who want to take advantage of higher levels of fear. (Barron’s)

Steve Romick, “Our job is to protect capital first and get a return second.” (Barron’s)

A look at some other secular bear markets. (Big Picture)

Companies

Apple ($AAPL) isn’t the only tech company whose valuation has shrunk. (Asymco)

One final look at the deal Warren Buffett from Bank of America ($BAC). (Dealbreaker)

Dunkin’ Brands ($DNKN) trades at a premium to most other restaurant companies. (Barron’s)

One area where corporations are spending is wireless infrastructure from providers like Aruba Networks ($ARUN). (GigaOM, Fund My Mutual Fund)

The TouchPad fiasco tells us there is a market for tablet computers priced less than the iPad. (Babbage)

Groupon reaching for lower quality merchants to drive sales. (Felix Salmon)

Finance

Ritholtz on how to fix America’s banks. (Washington Post)

There is one group of companies that are happy when markets go crazy: the exchanges. (NYTimes)

On the trade-off between efficiency and stability. (Aleph Blog)

Economy

GDI vs. GDP: a tale of the recovery tape. (Calculated Risk)

More Bernanke speech reactions. In short wait until September. (WSJ, NYTimes, FT)

Check out the surge in oil rigs drilling for oil in the US. (Real Time Economics, Modeled Behavior)

We should be discussing the length of economic stimulus as much as the size. (Marginal Revolution)

Congress has self-control problems. (NYTimes)

Why manufacturing surveys matter. (Modeled Behavior)

Support grows for a plan involving mass mortgage refinancings. (Marketwatch)

Does America need manufacturing? (NYTimes)

Earlier on Abnormal Returns

What every one else was reading on Abnormal Returns this week. (Abnormal Returns)

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Mixed media

On the art of saying nothing. (The Reformed Broker)

Abnormal Returns is a founding member of the StockTwits Blog Network.