Quote of the day

Josh Brown, “The [stock] market, which once existed primarily for capital formation, has become little more than a mock-capitalist game aimed toward enriching only the participants, contributing little to the rest of the nation.” (The Reformed Broker)

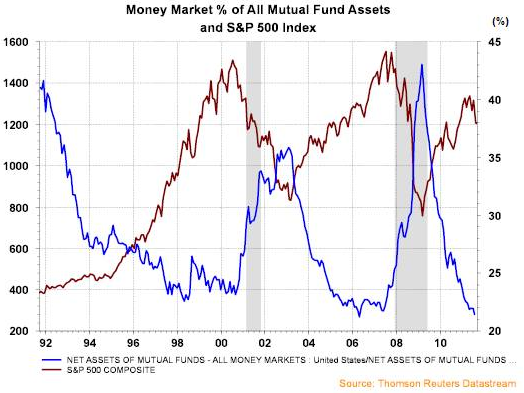

Chart of the day

Where’s all the cash? (Horan Capital)

Markets

Gold mining stocks are cheap. (Jason Zweig also Big Picture)

The percent of stocks above their 200 (and 50) day moving averages. (Fireside Charts, ibid)

Utilities have been the market leaders since August. (StockCharts Blog)

Q3 earnings estimates keep falling. (Bespoke)

Cheap stocks are still really cheap. (WSJ)

2011 is all about ‘all or nothing days.’ (Bespoke)

Another look at the Coppock Curve. (MarketBeat)

Check out the spread the 10 year Treasury yield and 30 year mortgage rates. (Bespoke)

Strategy

Still the biggest unknown for the market: can profit margins stay this high? (EconomPic Data also Buttonwood)

The Permanent Portfolio is hot these days. (Bloomberg)

The equity markets love the day before a FOMC meeting. (FRBNY via HistorySquared)

A transcript of the much talked about Ray Dalio talk. (Thinking in systems)

Companies

United Technologies ($UTX) is reportedly sniffing around Goodrich ($GR). (WSJ, Dealbook)

Can private equity swing a Yahoo! ($YHOO) deal? (Term Sheet)

Money management

Missed this earlier. TrimTabs is going to run an ETF based in part on float shrinkage. (Barron’s)

What the demise of Goldman Sachs’ ($GS) Global Alpha fund tells us about the markets. (CSS Analytics)

Felix Salmon, “In general, fund of funds are sold, not bought.” (Reuters)

Finance

There are no rogue traders, only rogue banks. (Big Picture also WSJ, Marginal Revolution)

A record year for scrapped IPOs. (Deal Journal)

On the TCW-Gundlach verdict. (WSJ, Money & Co., Dealbook)

Economy

The ECRI WLI is in full scale retreat. (MarketBeat, Pragmatic Capitalism)

Five possible scenarios for the Euro mess. (Money Game)

Are we worried too much about the decline of manufacturing? (Investing Caffeine)

John Maynard Keynes was an “incorrigible optimist.” (NYTimes)

Should economists be looking more to Charles Darwin than Adam Smith? (NYTimes)

Earlier on Abnormal Returns

What you missed in our Saturday long form linkfest. (Abnormal Returns)

What others were reading this week on Abnormal Returns. (Abnormal Returns)

Mixed media

Blogging is like working out. (The Basis Point)

A blog as learning environment. (Pragmatic Capitalism)

Abnormal Returns is a founding member of the StockTwits Blog Network.