Quote of the day

Chuck Jaffe, “No one needs a star manager to reach their goals.” (Marketwatch)

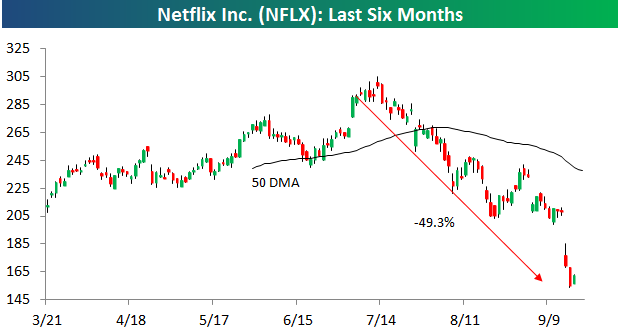

Chart of the day

Netflix ($NFLX) down 50% off it highs is your battleground stock of the day. (Bespoke)

Markets

A long term sell signal. (Money Game)

The week post-September options expiration is the weakest of the year. (Quantifiable Edges)

John Paulson is sticking to his guns. (WSJ, Market Blog)

Comparing dividend yields to various bond yields. (Big Picture)

More weakness in copper. (Bonddad Blog, chessNwine, The Technical Take)

Volatility is likely to persist. (Pragmatic Capitalism)

Strategy

Is low volatility investing a value play? (Falkenblog)

The 23 mutual funds in the Morningstar ($MORN) 401(k) plan. (Morningstar)

Software and brokers for options trading. (Condor Options)

When it comes to financial punditry, perception is reality. (Market Anthropology)

Companies

Is Netflix ($NFLX) still overvalued? (Crossing Wall Street also MarketBeat, SplatF, ROI, Tech Trade, NetNet)

Tyco ($TYC) is splitting into three companies. (Dealbook, Reuters, Deal Journal)

Apple ($AAPL) is back at new all-time highs. (CBS Moneywatch)

A look at FactSet Research Systems ($FDS). (research puzzle pix)

Daily deal sites are rapidly expiring. (WSJ)

ETFs

Three more agriculture-related ETFs are coming to market. (IndexUniverse)

More low volatility ETFs are set to launch. (ETFdb)

On the hype surrounding ETFs. (Random Roger)

Global

Emerging market equity funds have seen seven straight weeks of outflows. (FT, MarketBeat)

Things are bad in Europe when beer consumption is down. (Economix)

The future for Europe is not pretty. (Baseline Scenario)

Economy

FOMC previews: might the Fed disapopint markets. (Calculated Risk, Economist’s View, WSJ, FT, NYTimes)

Why the muddle through economy is likely to persist. (Pragmatic Capitalism)

Structural unemployment is getting sticky. (FT Alphaville)

The Great Stagnation vs. the Great Relocation. (Marginal Revolution)

Progress on the net worth front. (Crackerjack Finance)

Earlier on Abnormal Returns

Fantasy trading=fantasy football. (Abnormal Returns)

Is Bruce Berkowitz a dinosaur? (Abnormal Returns)

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Yet another departure from TechCrunch. (The Reformed Broker)

Abnormal Returns is a founding member of the StockTwits Blog Network.