Quote of the day

Bella, “There is a humongous gap between exposure to a profitable system and internalizing profitable trade set ups.” (SMB Training)

Chart of the day

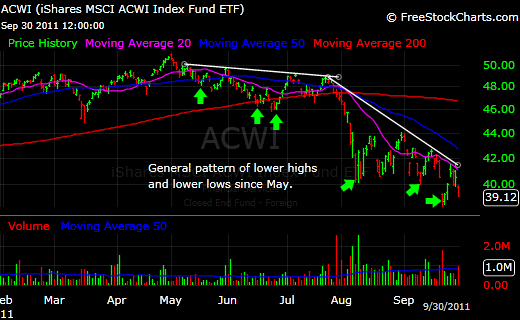

The bear market in one picture. (Finance Trends Matter)

Markets

Where market stand going in into Q4. (Big Picture, Humble Student)

Major asset class performance in September. (Capital Spectator)

The first trading day of the month is not a sure thing. (Quantifiable Edges, Bespoke)

What is driving utility sector returns? (StockCharts Blog)

Companies buying back shares are outperforming. (Horan Capital)

Stephanie Pomboy is looking for a continued “de-risking.” (Fortune)

The crash in copper. (Bonddad Blog)

How to play penny stocks: don’t. (Aleph Blog)

Perspective

Howard Lindzon, “In 2011, with all the tools at our disposal, investing in public companies should not be considered just a game.” (Howard Lindzon)

Just because everyone is bearish does not mean the secular bear market is over. (Risk and Return)

The case for a continued secular bear market. (FT Alphaville)

Things are way too f**king complicated. (Long or Short Capital)

Research

AQR is giving away $100k in search of new research. (Pensions & Investments)

How uncertainty over government policy affects stock prices, in theory. (Journal of Finance)

Routine insider trading has little information value. (Journal of Finance)

Do gold or gold miners exhibit any seasonal tendencies? (CXO Advisory Group)

Companies

How Apple ($AAPL) overtook Microsoft ($MSFT) in the last four years. (Asymco)

Marion Maneker, “Amazon is becoming the Wal-Mart of digital media to Apple’s high-end suburban mall. ” (Big Picture)

Apple may not announce iPhone 5 tomorrow. (SplatF)

iPhone announcement days are typically non-events for Apple ($AAPL) stock. (TechInsidr)

Finance

If banks are a black box why bother holding them? (WSJ)

No one trusts the banks. (The Reformed Broker, Clusterstock)

Goldman Sachs ($GS) is set to profit from a big bet on the London Metals Exchange. (FT)

Global

The UK is still AAA in S&P’s eyes. (FT Alphaville)

Inflation may have already peaked in China. (Crackerjack Finance)

The heavy hitters all are saying China is engineering a soft landing. (Money Game, FT Alphaville)

Economy

Three reasons not to fear recession. (MarketBeat)

More on the ISM Manufacturing Index. (Pragmatic Capitalism, Calafia Beach Pundit)

What is behind ECRI’s recession call? (Bonddad Blog,)

The economy will not be fixed until housing is fixed. (Fortune)

The Fed seems to believe in the structural unemployment thesis. (Economist’s View)

Do we need a more politicized Fed? Um, no… (Econbrowser)

The US has an industrial policy towards energy. It just not is a very good one. (James Surowiecki)

Earlier on Abnormal Returns

A mediocre economy and historically poor consumer sentiment: which is right? (Abnormal Returns)

What you missed in our Monday morning linkfest. (Abnormal Returns)

Top clicks this past week on Abnormal Returns. (Abnormal Returns)

Psychology

Economists need to start taking envy seriously. (Falkenblog)

Why do sandwiches taste better when some one else makes them? (Farnam Street)

Every marriage has money issues. (Bucks Blog)

The cost of changing your mind. (HistorySquared)

Media

Twitter is the new “information network.” But how does it ultimately make money? (NYMag)

A podcast with SumZero’s Divya Narenda. (Tradestreaming)

Chess, “Becoming a successful financial blogger with a broad and loyal reader base is extremely rewarding, but is also as much of a challenge as anything else you can attempt with no start up capital required.” (chessNwine)

Abnormal Returns is a founding member of the StockTwits Blog Network.