A quick note following up on a post we had earlier this week. In our post “A growing audience for dividends” we looked at the increasing interest in dividend-paying stocks. In this week’s Barron’s Michael Santoli looks at how the desire for dividends has changed relative valuations. Santoli writes:

ARE STOCK DIVIDENDS BLINDING investors to valuations? That’s what research by AllianceBernstein contends.

Vadim Zlotnikov, chief market strategist at the research shop, ranked the large cap universe of 650 stocks by their dividends. He compared the stocks in the top quintile with those at the bottom using both price to book and price to forward earnings. The result: The premium of high-dividend payers over low-dividend payers is the highest it has been over the past 40 years.

“The high-dividend trade is the most crowded trade in the world,” Zlotnikov argues. Conversely, deep-value, cyclical stocks are the most undervalued.

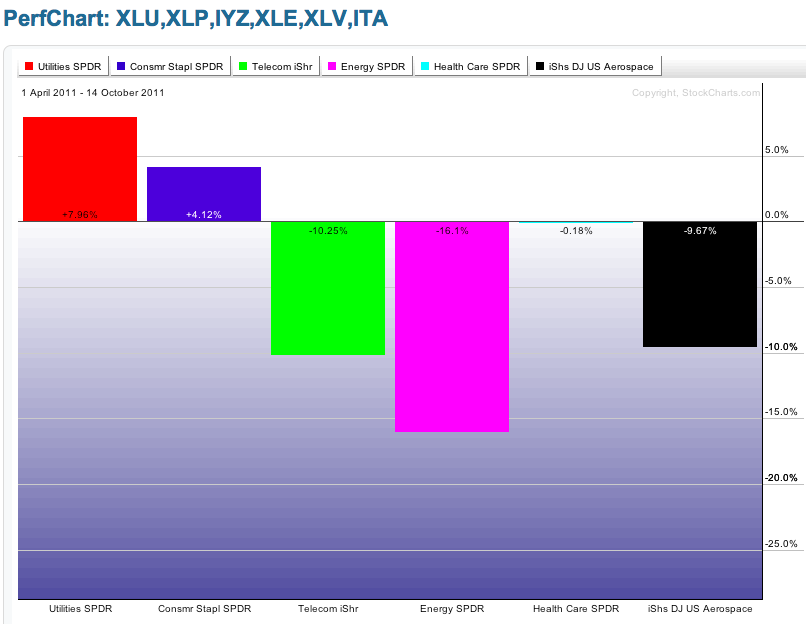

As always trends continue until they don’t, and that’s usually longer than expected. Zlotnikov suggests rebalancing portfolios between the two groups once every three to six months. And, he notes that within the dividend-paying universe, those in the utilities, staples and telecom sector are far more expensive than those dividend payers in energy, health care and defense.

Santoli goes on to highlight a specific pairs trade using this insight. We don’t access to the specific data mentioned above but let’s look at the relative performance of the broad sectors mentioned above. You can see how the utility and consumer staple sectors have outperformed since the beginning of April. The energy sector has been a notable laggard since then.

Source: StockCharts.com

Dividend-focused investors don’t necessarily need to give up their search for dividends, they just need to start looking in different places. The market stands still for any one…