Quote of the day

Barry Ritholtz, “Humans deal with financial losses in a very specific way — and its not fury.” (Big Picture)

Chart of the day

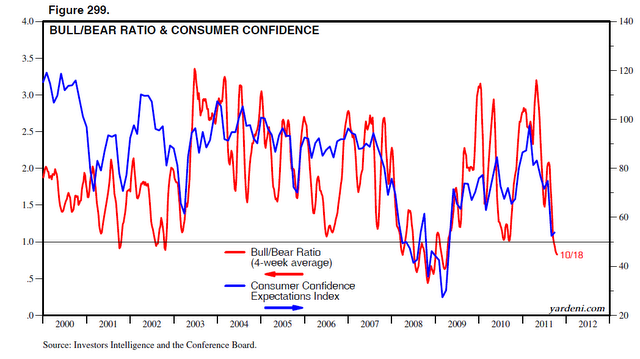

On the relationship between market sentiment and consumer confidence. (Dr. Ed’s Blog)

Markets

A review of what post-earnings announcement drift means. (Phil Pearlman)

Markets are tired of high volatility. (SurlyTrader)

Mainstream commodity indices are mostly energy. (MarketSci Blog)

Global oil production has been flat for a decade. (Gregor Macdonald)

Pairs reading

Bella, “Knowledge of a play is not enough. Saying you want to be a great trader is not enough. Sitting next to that great trader is not enough. Your trading career is about you finding the plays that make the most sense to you.” (SMB Training)

Scott Bell, “That’s the thing about investing. There aren’t many shortcuts or crystal clear road maps. In the end, common sense & listening to yourself is usually the best medicine. But sometimes the reptilian brain & self delusion get in the way. So, it’s always better to know thyself truly.” (I Heart Wall Street)

Strategy

How to trade gap openings. (Adam Grimes)

Three ways to overcome your fears from past (bad) trades. (SMB Training)

Some academic readings and the death of the SEO offering effect. (Turnkey Analyst)

Companies

Abbott Laboratories ($ABT) to split in two. (Dealbook, Crossing Wall Street, 24/7 Wall St.)

Intel ($INTC) has broken out of a two-year trading range. (Bespoke)

A Value Investing Congress round-up. (Market Folly)

Apple

Bloggers got clocked in regards to Apple ($AAPL) earnings. (Apple 2.0)

Apple is becoming an Enterprise company. (AllThingsD)

Every Apple analyst is saying ignore the earnings miss. (Money Game)

The Mac business is still chugging along. (SplatF)

Finance

Enforcing position limits is going to be tougher than it looks on first glance. (Falkenblog, Points and Figures, Term Sheet)

Seth Klarman is reportedly looking for some additional cash. (Institutional Investor)

On the similarities between Steve Jobs and Jack Bogle. (CBS Moneywatch)

Be wary when your broker shifts firms. (I Heart Wall Street)

ETFs

Ont he value of combining relative strength and low volatility strategies. (allETF)

Blackrock ($BLK) wants no part of leveraged ETFs. (MarketBeat, Focus on Funds)

Just in time for winter, iShares proposes Nordic ETFs. (IndexUniverse)

Global

The EFSF is too small. (Gavyn Davies also Real Time Brussels)

How the “ghost of Lehman Brothers” informs European reluctance to let Greece fail. (WashingtonPost)

Dollar down. Euro up. (The Source, ibid)

The surprisingly controversial history of Argentina’s default. (Megan McArdle)

Economy

The economy expanded in August. (Capital Spectator)

What if housing actually begins to contribute to economic growth? (Free exchange also CBP)

Annualized real GDP per capita is nowhere near its pre-recession highs. (The Atlantic)

The tension between debt levels, average maturity and interest outlays. (Global Macro Monitor)

How Fed policy is putting a cap on net interest margin at banks. (Credit Writedowns)

What would a mass mortgage refinancing do for the economy? (Wonkblog)

Richard Bernstein wants to turn the US into one big enterprise zone. (FT)

People get stocks and flows confused all the time. (Baseline Scenario)

Earlier on Abnormal Returns

Scotty, we need more dividends! (Abnormal Returns)

Attention is a zero-sum game. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

A way to improve the social sciences: separate the idea from the research. (Aleph Blog)

The top lists of all time. (Altucher Confidential)

Mat Honan, “Generation X is sick of your bullsh*t.” (Empty Age)

Abnormal Returns is a founding member of the StockTwits Blog Network.