Quote of the day

Howard Lindzon, “To get the best returns on your capital, do not pigeonhole your style with ‘words’.” (Howard Lindzon)

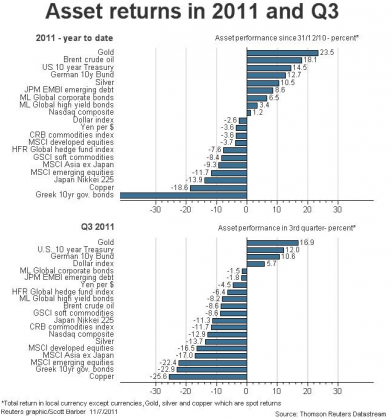

Chart of the day

Risk on/risk off: the year in asset class performance. (Reuters via @scottybarber)

Markets

S&P 500 earnings are on pace to set a record. (Bespoke, MarketBeat)

Three factors favoring the bulls. (The Reformed Broker)

The “real fireworks” from the European crisis have yet to be felt. (Market Anthropology)

Why interest rates are likely to stay low for awhile. (TheArmoTrader)

Remember the cotton bubble of early ’11… (WSJ)

Strategy

A look at four secular bear markets. (Big Picture)

Certainty, especially when it comes to forecasting the economy, is a mistake. (Interloper, Money Game)

A research paper on a better way to measure momentum. (Journal of Empirical Finance via @quantivity)

Companies

A look at Buffett’s latest moves at Berkshire Hathaway ($BRKB). (Bloomberg)

When, and if, will Siri be rolled out to other iOS devices? (GigaOM)

Investors are heavily short the shipping stocks. (FT also YCharts Blog)

Groupon ($GRPN)

Does Groupon need an adult in charge? (Businessweek)

Groupon is not the next Amazon ($AMZN). (SAI)

A profile of early Groupon investor New Enterprise Associates. (Fortune)

Groupon is already looking towards a secondary offering. (Crain’s Chicago)

Finance

Barry Ritholtz on what caused the financial crisis? (WashingtonPost)

There is a high yield default “wall” looming out in 2014. (Distressed Debt Investing)

What Jeffries Group ($JEF) has been up to. (FT Alphaville)

Is this a new private equity model? (Dealbook)

Why is Citigroup ($C) putting MORE money in its own hedge funds and PE funds? (Bloomberg)

Don’t trust a hedge fund that revises its performance. (Zero Hedge)

ETFs

ETF statistics for October. (Invest With An Edge)

What “funds” should be called ETFs. (WSJ)

The attraction of low volatility ETFs. (FT)

A missing ETF: a global publicly traded exchanges fund. (Random Roger)

Global

European banks still have a bunch of US mortgage-related assets on the books. (WSJ)

“Italian bond yields can’t remain at 7%.” (Crackerjack Finance)

The case for Chinese equities to outperform for a while. (Data Diary)

Economy

Expectations for a US recession stand at 50%. (Big Picture)

Another recession model is pointing down. (Hussman Funds)

Sluggish growth continues, but lookout for Europe. (Econbrowser)

An estimate on just how big is the Internet Economy? (The Atlantic)

The US energy economy is turning up for the first time in a long time. (Money Game)

On the myth of consumer deleveraging. (New Yorker)

Earlier on Abnormal Returns

Apple ($AAPL) fatigue. (Abnormal Returns)

What you missed in our Monday morning linkfest. (Abnormal Returns)

Books

Bill Easterly calls Daniel Kahneman’s Thinking, Fast and Slow![]() a “masterpiece.”* (FT)

a “masterpiece.”* (FT)

Steven Place has a new $VIX-focused e-book Timing Volatility: Measure Fear and Greed to Get an Edge in the Market![]() .* (Investing With Options)

.* (Investing With Options)

A new novel Something for Nothing by Michael W. Klein traces one year in the life of a young academic economist.* (Insider Higher Education)

Social media

In defense of Zero Hedge. (The Reformed Broker)

Sustainable, full-time finance blogging is tough. A change in model. (Credit Writedowns)

Best practices in finance-related social media. (Chicago Sean)

Abnormal Returns is a founding member of the StockTwits Blog Network.

*Amazon affiliate. You know the drill.