Quote of the day

Tyler Cowen, “Right now central banks need to be doing everything they can to avoid a second Great Depression.” (Marginal Revolution, ibid)

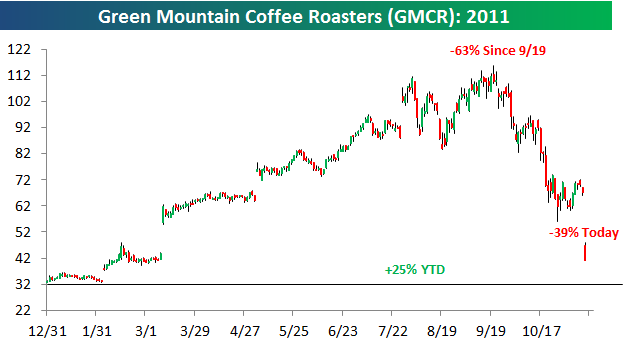

Chart of the day

Green Mountain Coffee Roasters ($GMCR) makes a round trip. (Bespoke also Kid Dynamite, Herb Greenberg)

Markets

Keep an eye on silver as a leading indicator. (Market Anthropology)

Doug Kass is “buying American.” (TheStreet)

Good advice for new traders. (The Fly)

Volatility strategies show a great deal of diversity in performance. (Total Return)

Ideas pitched at the Invest for Kids conference. (Distressed Debt Investing, Market Folly)

How investors trick themselves. (I Heart Wall Street)

Research

About that whole momentum echo effect… (SSRN via @quantivity)

How you hedge inflation depends on the economic regime. (SSRN via @quantivity)

Apple

Why Apple ($AAPL) may never be the same. (Phil Pearlman also SAI, MarketBeat)

Apple is an aspirational brand in China. (Apple 2.0)

Siri should make Google nervous. (TechCrunch contra SplatF)

Companies

Larry Page is trying to make Google ($GOOG) “leaner” and “less sclerotic.” (NYTimes)

How to get the most for all of the parts of Yahoo! ($YHOO). (Eric Jackson)

About that unvested equity you hold, the company might just want it back. (WSJ)

Finance

The IPO market is just fine. (Term Sheet)

Save the system vs. save the banks. (Big Picture)

Ten steps to fix the securities markets. (Points and Figures)

Securities analysts were too many hats these days. (NYSSA)

How to offset the risks of Europe to US banks. (The Atlantic)

Goldman Sachs ($GS) and Morgan Stanley ($MS) are looking for an edge. (Dealbreaker)

Global

Just how high can BTP yields go? (FT Alphaville)

Euro disintegration is the “talk of the town.” (MarketBeat, Credit Writedowns)

The downdraft from the Euro crisis is near. (Felix Salmon, NetNet)

The Fed should NOT buy Italian bonds, ever. (Credit Writedowns)

Is Europe ungovernable? (The Source, Freakonomics)

The long history of European yields. (Dr. Ed’s Blog)

The double-whammy of austerity in the UK. (Econbrowser, The Source)

Economy

Jobless clams are slowly improving. (Capital Spectator, Calculated Risk)

The risk to the US economy from the Euro mess. (Modeled Behavior)

Home prices keep dropping, albeit at a slower rate. (WSJ, The Atlantic)

Drilling down on Bernanke’s record on inflation. (Real Time Economics)

Earlier on Abnormal Returns

What you missed in our Thursday morning Euro-focused linkfest. (Abnormal Returns)

Mixed media

Josh Brown, “Gen Y doesn’t do business with people that they can’t look up online…” (Financial Adviser)

Howard Lindzon, “The less baggage in life the better…” (Howard Lindzon)

If you think investing is tough, try music. (Big Picture)

Comment of the day. (Dealbreaker)

Abnormal Returns is a founding member of the StockTwits Blog Network.