Quote of the day

Scott Bell, “The world is a very small place, with very few real choices, and very few opportunities for you to be part of the 1%. Once you accept this, your life will be simpler.” (I Heart Wall Street)

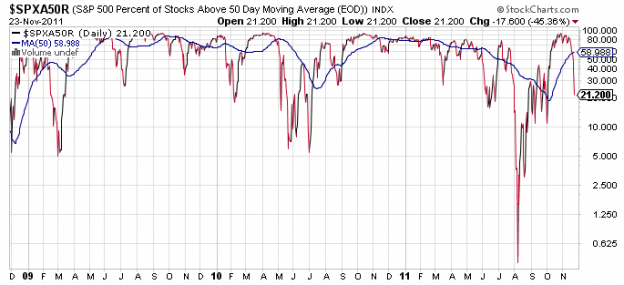

Chart of the day

S&P 500 stocks are oversold, but not dramatically. (Fund My Mutual Fund)

Strategy

Diversification is not dead. (Globe and Mail)

Where to look for yield in today’s environment. (Barron’s)

More evidence in favor of low volatility investing. (HistorySquared)

A look at relative strength strategy success. (Systematic Relative Strength)

Out-of-sample tests of the cornerstone strategies of What Works on Wall Street. (CXO Advisory Group, ibid)

The allure of dividends. (Jubak Picks)

Black Friday

Black Friday may not represent the best deals. (NYTimes)

The economics of Black Friday. (Marginal Revolution)

What not to buy today. (Slate)

Consumers these days are all about free shipping. (WSJ)

On the relationship between television viewing and household debt. (Finance Addict)

Companies

With the holiday shopping season upon us a look at Wal-Mart ($WMT). (Turnkey Analyst also StockCharts Blog)

The AT&T ($T) bid for T-Mobile is likely dead. (WSJ, FT)

If you think Netflix ($NFLX) has done a bad job with share buybacks, check out Cisco ($CSCO). (Bits)

Talk of an Internet meltdown is premature. (Term Sheet)

Finance

MF Global shows the desire of investors for even greater transparency. (FT)

The lessons of Margin Call![]() . (Felix Salmon)

. (Felix Salmon)

Can the SEC realistically investigate insider trading in Congress? (Dealbook)

Funds

Tough times for money market funds these days. (FT Alphaville)

Ten reasons ETFs are better than mutual funds. (ETFdb)

Beware the managers of financial TV begging for assets. (Interloper)

India

Things aren’t much better for the Indian stock market. (Bespoke)

India is opening up to foreign retailers. (NYTimes)

Why has the rupee been so weak? (Economist)

Global

Short Euro may not be the best way to play the Euro crisis. (macrofugue)

The final phase of the Euro crisis is here. (Free exchange)

European banks have a lot of deleverging to do. (IFR via Money Game)

The Yen doesn’t operate like other currencies. (The Source)

Sweden is moving to raise capital standards for its banks. (Dealbook, The Source)

The world wants more US debt. (Economist’s View)

A look at global sovereign CDS prices. (Bespoke)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Why you should care about StockTwits. (Investis)

The best non-fiction books of 2011. (Marginal Revolution)

How to be the best entrepreneur in the world. (James Altucher)

Abnormal Returns is a founding member of the StockTwits Blog Network.