Quote of the day

Adam Davidson, “Failure is as important to healthy capitalism as success. The nation’s handful of huge banks, however, are spared the indignity of failure.” (NYTimes)

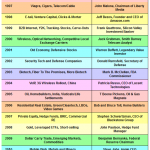

Chart of the day

Investing themes and fads by year, 1996-2011. (The Reformed Broker)

Markets

20 truths about the stock market. (Ivanhoff Capital)

20-year rolling Dow returns exhibit big swings. (Big Picture)

High asset class correlations seem to be easing a bit. (Bespoke also MarketBeat)

Corporate insiders are surprisingly bullish. (Mark Hulbert)

Here’s hoping 2012 at least demonstrates a trend. (Interloper)

Commodities

The divergence between commodities is notable. (Tyler’s Trading)

What is the primary trend in gold? (Jesse’s Cafe Americain)

What are raw material prices saying about the stock market. (Dr. Ed’s Blog)

Beware the farmland price bubble. (WSJ)

Strategy

How to pick stocks amongst the megacaps. (Aleph Blog)

Equity in big, multinationals are the new bonds. (Curious Capitalist)

Burton Malkiel on how to deal with low interest rates. (WSJ)

Companies

The economics of OpenTable ($OPEN). (Bloomberg)

Yahoo! ($YHOO) doesn’t have any easy choices. (Dealbook)

What the new Windows phone platform is up against. (Asymco)

Apple’s ($AAPL) stock price implies future sales declines. (Apple 2.0, MarketBeat)

First IBM ($IBM) now solar for the new Berkshire Hathaway ($BRKB). (CNNMoney)

Can companies faced with a recession become too conservative? (Free exchange)

Finance

The LBO boom of 2006-08 is coming home to roost. (FT)

It is hard to value investment banks when their business models are under threat. (research puzzle pix)

Why a “Robin Hood” tax on financial transactions won’t work. (NetNet)

Securities analysts are becoming increasingly specialized in a tough jobs market. (Distressed Debt Investing)

Pimco goes Latin. (beyondbrics)

Funds

Why buying the hot hand often leads to disappointment. (Fortune)

Why Fidelity had to get into the ETF business. (ETF Replay)

The ETF revolution is complete. The Global X FTSE Greek 20 ETF ($GREK) is set to launch. (MarketBeat)

More dividend-focused emerging market ETFs are coming to market. (IndexUniverse)

Global

Do sovereign debt ratings matter all that much? (NetNet)

Why Q1 2012 is so important to Europe. (Pragmatic Capitalism)

The slowdown in China is now here. (WSJ)

India backtracks on the idea of opening up its retail sector to foreign investment. (The Source)

Some good news for the Global 99%. (Business Insider)

Forecasting follies

Trust real data not surveys. (Big Picture)

Jason Zweig, “People are almost freakishly inept at forecasting their future behavior.” (Total Return)

Economy

Why spending may be holding up better than expected. (Real Time Economics)

How demographic shifts are affecting labor participation rates. (Tim Duy)

TIPS-derived inflation expectations are picking up. (Capital Spectator)

What say the Taylor Rule? (Stone Street Advisors)

Parsing the Bloomberg vs. Fed fight. (Felix Salmon, FT Alphaville, Finance Addict)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Why sugar makes you sleep and protein wakes you up. (The Frontal Cortex)

How do you define yourself? (Points and Figures)

Flipboard comes to the iPhone. (Technologizer, ibid)

Abnormal Returns is a founding member of the StockTwits Blog Network.