Quote of the day

Philip Stephens, “Ever since it negotiated the single currency opt out at Maastricht nearly 20 years ago Britain has managed by dint of power and skilful diplomacy to be both within and without the European club. Mr Cameron’s decision to leave an empty chair at negotiations for a fiscal union in the eurozone marks the end of that road.” (FT)

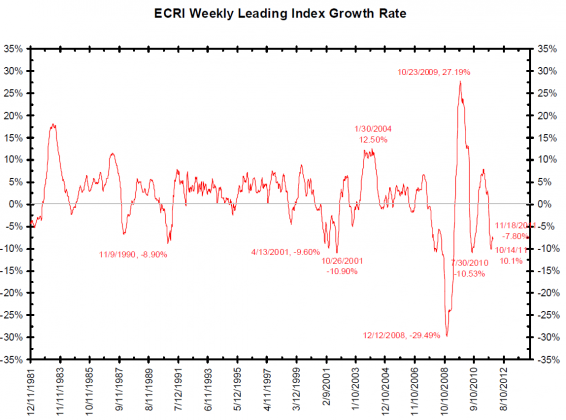

Chart of the day

The ECRI is sticking with its recession call, even if it takes a year to play out. (Big Picture, MarketBeat)

Markets

The stock market is pricing in a drop in earnings. What if it doesn’t happen? (Crossing Wall Street)

Can the $VIX signal market direction? (Climateer Investing)

Agricultural commodities look weak. (Dragonfly Capital)

Strategy

David Merkel, “It is hard, really, really hard to choose the best assets. I can’t do it. It is easier to choose assets that are better than the ones you currently own.” (Aleph Blog)

The case for low volatility investing. (Marketwatch)

On the importance of stops. (bclund)

Successful trading is about managing risk. (Finance Trends Matter)

Hedging your portfolio with volatility products. (SurlyTrader)

Do spread trade candidates need to be in the same industry? (Bigger Capital)

On the importance of diversifying across time horizons. (Institutional Investor)

Companies

A look at Q1 2012 Apple ($AAPL) earnings. (Asymco, MarketBeat)

Amazon ($AMZN) eschews profits unlike Apple. (YCharts Blog)

Yahoo’s ($YHOO) Alibaba stake is valuable and a big complication. (Dealbook)

The bleak picture at Research in Motion ($RIMM). (MarketBeat)

What’s weighing on Fusion-io ($FIO) shares? (TechInsidr)

What is DuPont ($DD) saying about the global economy? (MarketBeat)

Good work if you can get it: board members at International Gaming Technology ($IGT) get big raise. (footnoted)

Finance

The junk bond market is once again open. (WSJ)

It’s tough getting a new ratings agency off the ground these days. (Dealbook)

The crowdfunding bill nears reality. (I Heart Wall Street)

Distressed debt investors are flocking to Europe. (FT)

Funds

Not every niche or new strategy is a new asset class. (Minyanville)

Bond ETFs are taking share from mutual funds. (Focus on Funds)

Another sign mutual funds are feeling the pressure from ETFs. (Forbes)

Alternatives

The tough year in hedge fund land. (research puzzle pix)

Why VCs love online retail. (peHUB)

Private equity’s changing landscape. (Pension Pulse)

Global

The reviews are rolling in on the latest and not so great Euro deal. (Free exchange, Business Insider)

Why Europe never planned for this sort of eventuality. (Justin Fox)

Europe still doesn’t have a plan to growth. (Gavyn Davies)

Four surprising things about the European bank stress tests. (Finance Addict)

Emerging markets are due for some catch up. (Bloomberg)

Over the next decade an “equity gap” may open up. (Real Time Economics, Dealbreaker)

Economy

Rail traffic increased in November. (Calculated Risk)

Consumer sentiment is perking up. (Calculated Risk, CXOAG)

Looking at the lost decade(s) for the US economy. (Econbrowser)

Medical patents must die. (Marginal Revolution)

The good, bad and ugly of the US housing market. (Sober Look)

What does not in the labor force mean? (Bonddad Blog)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

What Heidi Moore reads. (Atlantic Wire)

Ten takeaways from the new, new Twitter. (SplatF also Daring Fireball)

Abnormal Returns is a founding member of the StockTwits Blog Network.