Quote of the day

Jonah Lehrer, “Sometimes, the best thing we can do is not learn from what just happened.” (The Frontal Cortex)

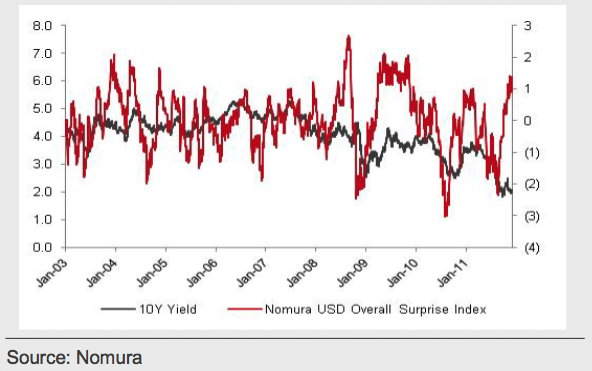

Chart of the day

Treasury yields would be rising if it weren’t for those pesky Europeans. (Money Game)

Markets

Given the Euro crisis 2:30AM is the new starting of the trading day. (NYTimes)

Treasuries vs. equities: which is correct? (MarketBeat, ibid)

The market is taking a break from the “dire situation” in Europe for now. (Dynamic Hedge)

Watch out traders “clearly erroneous trades” are on the rise in these more automated markets. (WSJ)

Why natural gas prices are likely to continue their decline. (Sober Look)

Strategy

Five equity-focused themes for 2012. (Richard Bernstein Advisers via Pragmatic Capitalism)

Debt isn’t evil. A strategy for the not so faint of heart. (Economic Musings)

A look at industry ranks. (Aleph Blog)

There is a dearth of volatility opportunities. (Tyler’s Trading)

Bill Gross is once again on the Treasury train. (MarketBeat)

The opportunity in selling index options. (WSJ)

Which valuation metric performs best? (Turnkey Analyst)

What a classic paper tells us about chart patterns and trends. (Derek Hernquist)

Companies

A look at megacap Johnson & Johnson ($JNJ). (Turnkey Analyst)

Five things Meg Whitman needs to do at Hewlett-Packard ($HPQ). (Marketwatch)

Finance

Are funds at US brokers safe? (Jesse’s Cafe Americain)

Is Warren Buffett freezing out a negative analyst. (Deal Journal, NetNet)

“Shovel in” rounds are the new IPO. (TechCrunch)

Funds

Active strategies have a definite tax cost. (World Beta)

Betting on the apprentice, when the master goes bad. (WSJ)

Global

The case for Europessimism: short-term gain vs. long-term pain. (Tim Duy, FT Alphaville)

Shocking to hear questions raised about the new Euro “fiscal compact.” (WSJ)

The ECB is on a perilous path. (Money Game)

Perspective on the UK and EU going splitsville. (Economist, Der Spiegel, Daily Beast, Time)

Peripheral Europe will not be able to grow its way out its problems. (Megan McArdle)

Good lesson: China (or any other country) is not a one-way bet. (WSJ)

Economy

A look at recent economic trends. (VIX and More, ibid)

How the Baby Boomers are affecting the labor market. (FT Alphaville)

The structural adjustment facing the middle class. (Economist’s View)

The FOMC is going to become increasingly dovish. (FT Alphaville)

Earlier on Abnormal Returns

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Mixed media

Great list: things learned in 2011. (Chicago Sean)

Don’t confuse correlation and causation. (The Reformed Broker)

Why we persist with unrealistic optimism. (BPS via Attitrade)

Fathers get the stingiest presents at Christmas. (Telegraph)

Abnormal Returns is a founding member of the StockTwits Blog Network.