Quote of the day

Howard Lindzon, “The smartest worriers are learning to code or marrying a developer.” (Howard Lindzon)

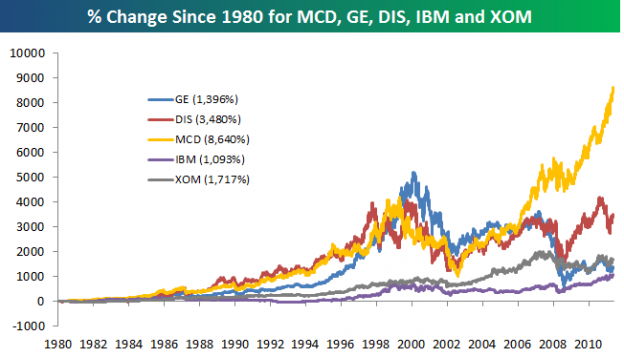

Chart of the day

When it comes to brand name companies one stands apart. (Bespoke)

Markets

Where’s the bubble: gold or the S&P 500? (Big Picture)

December options expiration week is historically one of the best of the year. (Quantifiable Edges)

The volatility of 2011 illustrated. (AlphaTrends)

The case for even lower Treasury rates. (Market Anthropology, MarketBeat)

A look at negative real interest rates. (macrofugue)

The myth of cash on the sidelines. (Big Picture)

Commodities

Gold is breaking down. (Fund My Mutual Fund, The Source, MarketBeat)

Why are the ag stocks so weak? (Investing With Options)

How to play lower corn prices via equities. (Peter L. Brandt)

Risk off: China and commodities look none too strong. (Global Macro Monitor)

Strategy

What is the best way to pay for financial advice? (WSJ, Big Picture)

Why do we keep building portfolios riskier than we can handle? (Bucks Blog)

Properly calculated hedge funds don’t deliver alpha on average. (SSRN via FT)

Companies

The bounce in homebuilders. (research puzzle pix)

Why is LinkedIn ($LNKD) stock so expensive? (Fortune)

The components of an Apple TV are “hiding in plain sight.” (Asymco)

MF Global

How Jon Corzine transformed MF Global and helped kill it in the process. (Dealbook)

Jon Corzine as rogue trader. (Felix Salmon)

The worst possible outcome for MF Global customers. (Calculated Risk)

Finance

On the prevalence of ‘zombie’ private equity funds. (FT)

Can Wall Street reinvent itself? (Fortune)

Say what you will the guys in capital markets work hard. (Interloper)

ETFs

The ETF Deathwatch just keeps getting longer. (Invest With An Edge)

Another broad-based commodity ETF targeting contango joins the fray. (IndexUniverse)

2011 was the year of the bond ETF. (ETF Trends)

Global

A tangled web: European banks have sold each other CDS on sovereign debt. (WSJ)

Euro bond spreads are back on the rise. (Bespoke)

The rest of Europe can’t be like Germany. (Crackerjack Finance)

Falling food prices and emerging market outperformance. (Pragmatic Capitalism)

Economy

An FOMC preview. (Calculated Risk, MarketBeat)

A sign of hope for the housing market. (Money Game)

The double-standard on default: corporations vs. households. (New Yorker)

Books

The Walter Isaacson biography of Steve Jobs![]() is the number one selling book on Amazon in 2011. (TechCrunch)

is the number one selling book on Amazon in 2011. (TechCrunch)

Three good reasons to read Alex Tabarrok’s Launching the Innovation Rensaissance![]() . (Modeled Behavior)

. (Modeled Behavior)

A rave review for Dick Stoken’s Survival of the Fittest for Investors: Using Darwin’s Laws of Evolution to Build a Winning Portfolio![]() . (Reading the Markets)

. (Reading the Markets)

A firsthand accounting of the art and science of risk management: Aaron Brown’s Red Blooded Risk: The Secret History of Wall Street![]() . (Falkenblog)

. (Falkenblog)

Social media

Is social media peaking? (A VC)

A social sanity manifesto. (HBR)

How to properly build your reputation on social networks. (Seth Godin)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Can management be taught? (Emanuel Derman)

Abnormal Returns is a founding member of the StockTwits Blog Network.