Quote of the day

Tim Richards, “The fact that it’s easy to invest in shares doesn’t mean that investing in shares is easy. If it were then no one would need to work for a living.” (The Psy-Fi Blog)

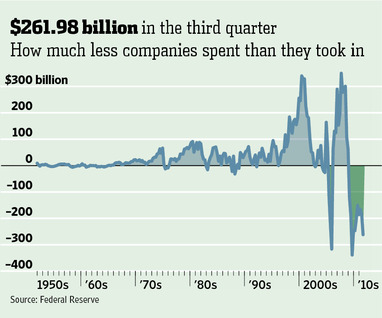

Chart of the day

Cash on the balance sheets of corporate America illustrated. (Real Time Economics also The Reformed Broker)

Markets

Twas the week before Christmas…How does the S&P typically perform? (Bespoke, CXO Advisory Group)

YTD stock market returns by country. (Bespoke)

In support of a year-end rally. (Market Anthropology)

Stuck in the middle of the range feels like a victory to no one. (Dynamic Hedge)

Are commodities ready for a repeat of 2008? (MarketBeat)

The muni bond market is a “quiet backwater of increasingly positive credit conditions.” (MuniLand)

The VIX

The stock market is falling alongside the $VIX. Where’s the fear? (MarketBeat also SoberLook)

The $VIX=The St. Louis Fed Financial Stress Index. (VIX and More)

Companies

Unlike most companies Amazon ($AMZN) really is being managed for the long run. (NYTimes also Musings on Markets)

Rolfe Winkler, “Facebook needs more Zyngas ($ZNGA).” (WSJ)

Research in Motion ($RIMM) really has only one winning strategy at this point. (Musings on Markets also Globe and Mail)

The failure to forecast: the case of Apple ($AAPL) earnings. (Asymco also Bullish Cross)

Finance

Just how strong is the SEC’s case against Fannie and Freddie? (Dealbreaker)

The international aspects of the collapse of MF Global. (Barry Ritholtz)

Why trade CDS when you can just short the bonds? (Dealbreaker)

Is the market fundamentally broken? (Leigh Drogen)

Hedge funds

Another hedge fund legend fesses up to having a bad year. (Deal Journal)

Dissatisfaction with poor hedge fund performance is growing. (Reuters)

Alpha is a scarce resource these days. (Pension Pulse)

Funds

If every broker offers commission-free ETFs is it really an advantage any more? (IndexUniverse)

Investors continue to swap equity funds for bond funds. (MarketBeat, Horan Capital)

How did the Invesco PowerShares S&P 500 Low Volatility Portfolio ($SPLV) garner $700 million in AUM? (IndexUniverse)

Global

Steve Randy Waldman, “But if European states become dependent on bank finance, they become dependent on ECB finance.” (interfluidity)

ECB lending will not solve the Euro crisis. (Felix Salmon)

No single meeting will solve the problems in Europe. (A Dash of Insight)

Is the European debt crisis already over? (Money Game)

Why the UK may very well regret its decision to go it alone. (Economist)

Economy

Breaking down CPI. (EconomPic Data, Calafia Beach Pundit, Calculated Risk)

Financial crises matter to the economy. (NYTimes)

The behavioral economics of gift giving. (Dan Ariely)

Earlier on Abnormal Returns

What everyone else was reading on Abnormal Returns last week. (Abnormal Returns)

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Mixed media

Four reasons Apple should make a 7 inch iPad. (GigaOM)

The Internet is not just for computers these days. (NYTimes)

Social media can make finding alternative viewpoints easier. (Fast Company)

More reactions to the Louis C.K. “experiment.” (A VC)

Abnormal Returns is a founding member of the StockTwits Blog Network.