Quote of the day

bclund, “There are very few mistakes in life or in the markets you can’t survive (and learn) from, but the key is to react swiftly, decisively, and in a way that contains the damage, not that makes it worse.” (bclund)

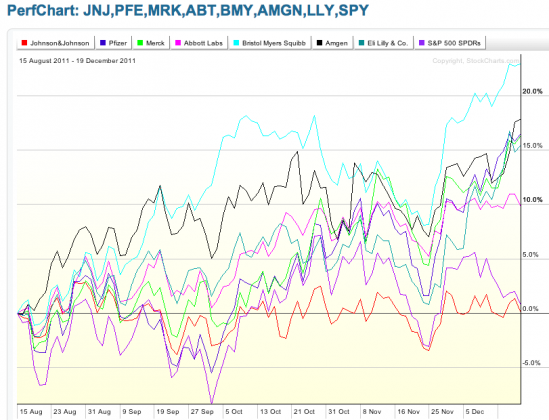

Chart of the day

Big pharma, including Pfizer ($PFE) has been on a tear of late. (StockCharts via Minyanville)

Markets

Sometimes the news really is non-news. (The Reformed Broker)

The argument for a Santa Claus rally. (Market Anthropology, Crossing Wall Street)

The market has already priced in a fair amount of uncertainty for 2012. (Crackerjack Finance)

Behold the power of the slope of the yield curve. (Crossing Wall Street)

High yield bond spreads are in a range. (Bespoke)

The muni bond market is going to figure out something else to talk about in 2012. (Income Investing)

What industry groups are most like the S&P 500. (Minyanville)

Strategy

Ivanhoff, “There is no one perfect momentum approach that will let you capture all big winners.” (Ivanhoff Capital)

Fractals and the importance of time frame diversification. (CSS Analytics)

When in doubt, read the footnotes. (research puzzle pix)

How corporate real estate holdings affect company risk and returns. (Turnkey Analyst)

Avoid finance professionals unable to say “I don’t know.” (Bucks Blog)

Finance

The double-edge sword of investment banks buying pre-IPO shares for its clients. (Dealbook)

The Wall Street-Washington nexus is disturbing on a number of levels. (WSJ)

Can Simplify actually simplify banking? (CNNMoney)

Funds

Commodities traders exit banks for hedge funds. Who can blame them? (Bloomberg)

The ugly year in hedge fund returns in 2011. (WSJ)

Fidelity is making its portfolio managers multi-task. (Morningstar)

Go-anywhere mutual funds, like hedge funds, have had a tough go of it of late. (WSJ)

Another MLP ETF is coming to market. (IndexUniverse)

Global

A trip around the synchronized global slowdown. (Credit Writedowns)

Does Germany really want the rest of Europe to resemble Germany? (Bloomberg)

Checking in on Australian banks. (FT Alphaville)

Has the Mexican Peso bottomed? (FT)

Iran is not the only risk to global oil supplies. (The Source)

Economy

Housing starts are still kind of “moving sideways.” (Calculated Risk also Modeled Behavior, Capital Spectator, Bonddad Blog)

There is some unacknowledged seasonality to economic surprises. (FT Alphaville)

Hoping for some positive feedback effects in the US economy. (Free exchange also Pragmatic Capitalism)

Why are Americans so bad at savings? (Planet Money, ibid)

Our policy towards high-skill immigrants is incomprehensible. (The Atlantic)

Earlier on Abnormal Returns

Leigh Drogen on the “gravity well of social finance.” (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Om meets Horace. (GigaOM)

The real reason investment clubs are drying up. (Tradestreaming)

Abnormal Returns is a founding member of the StockTwits Blog Network.