Quote of the day

Howard Lindzon, “What you pay and who you pay has always mattered and people are starting to care again.” (Howard Lindzon)

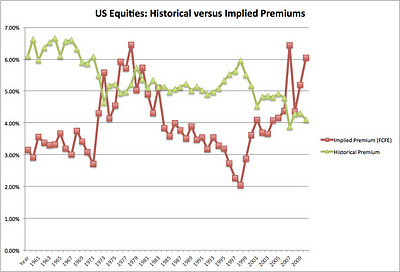

Chart of the day

Checking in on the historical and implied equity risk premia. (Musings on Markets)

Seasonality

January “has not impressed” over the past decade. (MarketSci Blog, ibid)

What typically happens in the first trading week of the year. (Bespoke)

Markets

Six events that shaped markets for better or worse in 2011. (A Dash of Insight)

Investors are entering the year chastened a touch more realistic. (Economist)

Equities like some inflation. Hence these charts. (Crossing Wall Street, Horan Capital)

Why investors are paying so much attention to dividend paying stocks. (NYTimes)

The earning estimate gap for 2012 is still notable. (MarketBeat)

Five more surprises from Doug Kass. (TheStreet)

Strategy

On the benefits of buy-write strategies in today’s environment. (Barron’s, Minyanville)

How constant updates affect the way we view markets. (Derek Hernquist)

Behold the 2012 Buy List. (Crossing Wall Street)

Where one TAA model stands going into the new year. (MarketSci Blog)

Commodities

Silver is no longer the “canary in a coal mine” it used to be. (Market Anthropology)

Natural gas closed at its lowest level in three years. (WSJ)

Markets at work. Iowa farmers are putting every possible acre into production. (NYTimes)

Companies

Bullish takes on two trucking-relate companies Paccar ($PCAR) and Cummins ($CMI). (Barron’s, ibid)

Facebook is not killing Google ($GOOG). (SAI)

Finance

Ten financial forecasts you can safely ignore in the new year. (WashingtonPost)

Is your brokerage account safe? (WSJ)

Mortgage rates are at sixty year lows with few takers. (WSJ)

Funds

2011 ETF performance and more. (EconomPic Data)

What you get when you leave your portfolio to so-called “gurus.” (research puzzle pix)

Global

Foreign central banks cut their holdings of US Treasuries. (FT)

Emerging market volatility is getting its own futures contract. (VIX and More)

Economy

Six economists, six solutions for our economic woes. (NYTimes)

The case for moderating inflation. (Calculated Risk, Carpe Diem)

Economic indicators are once again turning up. (Global Economic Intersection)

Pickup sales are rising at a good clip. Where’s the housing recovery? (WSJ)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

What you missed in our long form Saturday linkfest. (Abnormal Returns)

Mixed media

2011 was not a great year for simplicity in technology. (Slate)

2012: Let the adventure begin. (The Reformed Broker)

Abnormal Returns is a founding member of the StockTwits Blog Network.