Quote of the day

David Blair, “Rule respecting traders are the ones who are not afraid to take a loss. In fact, they expect every trade to be a loss and are surprised when they win. ” (Crosshairs Trader)

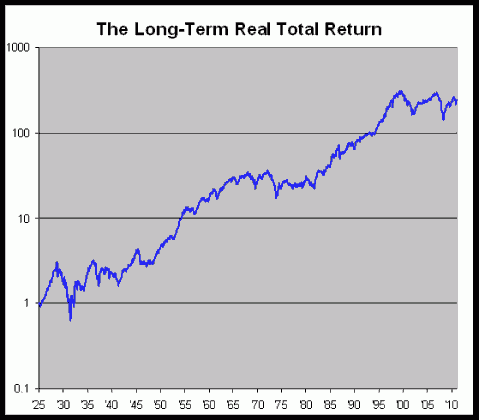

Chart of the day

The first decade of the new century has been a bummer for the S&P 500. (Crossing Wall Street)

Markets

Comparing major asset class performance in 2011. (Capital Spectator)

A look back at the year in volatility and the $VIX. (VIX and More)

Historically a big first trading day does not mean much for the rest of the year. (MarketBeat also Quantifiable Edges)

The equity risk premium looks attractive going into the new year. (Horan Capital)

Behold a bearish market strategist. (MarketBeat)

Strategy

Do you see any “fat pitches” out there? (The Reformed Broker)

Tyler Craig, “Stories are a lousy substitute for a chart. ” (Tyler’s Trading)

Why are we so reluctant to use realistic return expectations for planning purposes? (the research puzzle)

Testing a $VIX for the Treasury market. (SSRN via @quantivity)

You can’t plan for every contingency. (Bucks Blog)

Five trading resolutions worth a look. (Bigger Capital)

Companies

Demand for LNG tankers is up. (Bloomberg)

Whole Foods ($WFMI) is the next Starbucks ($SBUX). (Leigh Drogen)

The rise and fall of OpenTable ($OPEN). (CNNMoney)

Finance

Ted Wechsler joins Berkshire Hathaway ($BRKA) this month. (WSJ, Deal Journal)

Meet one of America’s highest paid CEOs who leaves “nothing on the table.” (Daily Beast)

ETFs

The year in ETFs. (IndexUniverse)

How much lower will ETF fees go? (ETFdb)

Hedge funds

2011 was the year of the whipsaw for hedge funds. (WSJ)

Don’t invest in hedge funds until reading Simon Lack’s The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True![]() . (Reading the Markets)

. (Reading the Markets)

Global

There is still only one way for Europe to prevent a meltdown. (Free exchange)

The global economy needs a good dose of inflation to thrive. (Foreign Policy)

Chinese growth is not out of the woods. (Sober Look)

Russia is a high beta economy. (Streetwise Professor)

Economy

The Taylor Mankiw Rule is signalling higher rates. (Crossing Wall Street)

The ISM Manufacturing Index indicates further growth. (Bloomberg, Capital Spectator, EconomPic Data)

Ignoring monetary or fiscal policy, big chunks of the economy move to their own beat. (Money Game)

How close did we come to recession in 2011? (Bonddad Blog)

There is a big difference between income inequality and consumption inequality. (WSJ)

Earlier on Abnormal Returns

We are giving away some recently published books during Abnormal Returns Reader Appreciation Week. (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Why are all movie ticket prices the same? (The Atlantic)

Eight lazy ways to lose weight. (New Scientist)

Can we really unplug from the Internet? (Slate)

Abnormal Returns is a founding member of the StockTwits Blog Network.