Every new year is filled with financial strategists, pundits and gurus weighing in with their predictions and forecasts for the financial markets. You can see this year’s many examples over at Pragmatic Capitalism. The problem is not in the forecasts themselves which will if history is any guide turn out to be a mixed bag by year end. The problem is when investors take these forecasts seriously and adjust their financial plans accordingly. This is by all accounts confuses what is an exercise in publicity with actual investing.

Carl Richards, the now controversial, financial planner and author has made frequent appearances on Abnormal Returns via his work at the Bucks Blog and Behavior Gap. Carl is also the author of the newly published book, The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money![]() . This excerpt from Carl’s book talks about the mistake we make in confusing what we see and hear in the financial media with actual investment advice.

. This excerpt from Carl’s book talks about the mistake we make in confusing what we see and hear in the financial media with actual investment advice.

Investing Is Not Entertainment – Carl Richards

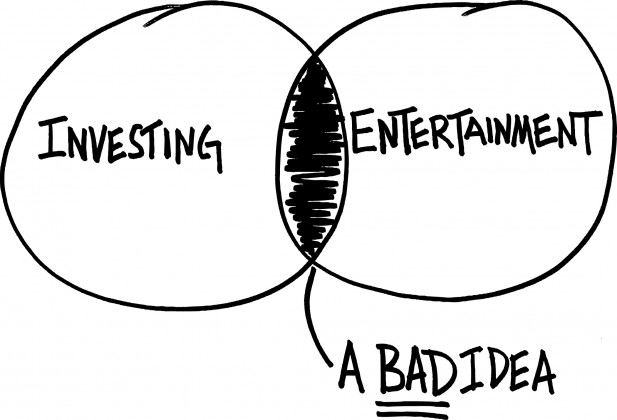

We get into trouble when we confuse investing with entertainment.

A decade or so ago, investing had become America’s favorite spectator sport. Everywhere you went people were talking about finding the next hot stock, mutual fund, or alternative investment. Magazines with covers like “Ten Hot Funds to Buy Now” and “Five Stocks That Sizzle” made investing sound fun. You couldn’t turn on the television without seeing some lout screaming “Buy! Buy! Buy!”

Most of the stock market coverage in the media was designed to appeal to our fantasies about getting rich quickly—our wildest financial hopes and dreams. And most of us were eager to swallow the story that we could get rich quickly in stocks. So, despite knowing at some level that market timing, stock picking, and day-trading are hazardous to our wealth, many people still did those things.

Source: Carl Richards

Every one of those investors would have benefited from asking these questions: Am I investing to meet my most important financial goals, or am I investing as a form of entertainment? Am I being realistic, or am I letting my fantasies run away with me?

Sure, investing is fun while you’re making money. And it’s fun to indulge in occasional daydreams about getting rich the easy way. But this is not Monopoly. This is real life. We’re dealing with real money and real goals. When we forget that—when we confuse investing and entertainment—we almost always end up behaving badly.

So next time you are tempted to “play the stock market” maybe you should go to the movies instead.

Excerpted from The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money. Published by Portfolio/Penguin. Copyright Carl Richards, 2012.