Quote of the day

Tyler Craig, “The combination of two crappy strategies won’t magically produce a winning approach.” (Tyler’s Trading)

Chart of the day

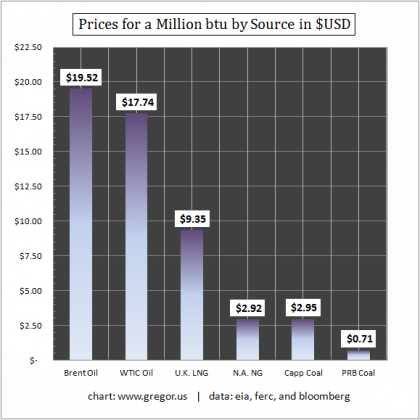

Oil prices relative to natural gas continue to diverge. (Gregor Macdonald also Donald Marron)

Markets

The counter-narrative pointing toward a continued rally. (The Reformed Broker, MarketBeat)

The Nasdaq 100 ($QQQ) is itching to break out. (All Star Charts)

Individuals are still expecting a market crash. (Bespoke)

Hedge funds have still not bought into the rally. (Stock Sage)

Is the $VIX signaling time to get back into the stock market? (Mark Hulbert)

Strategy

Try to be in the market as little as possible. (Joe Fahmy)

How fundamental analysis can help forecast option returns. (SSRN via CXOAG)

Random results

Small sample sizes often lead to irrelevant results. (Adam Warner)

Investors confuse causation and correlation all the time. (Big Picture)

Companies

Lululemon ($LULU) is back amongst the market leaders. (chessNwine)

What effect is Amazon Prime having on the company? (YCharts Blog)

What companies did a good job of buying back stock last year? (Globe and Mail)

Apple

How to roll your own Apple ($AAPL) dividend. (Barron’s)

Apparently a lot of buyers were waiting for the iPhone 4S. (SAI)

How much farther ahead is the iPhone than the rest of the industry? (SplatF)

Finance

Why bother with tax shelters when you can simply pass-through? (WSJ)

Have banks cut pay enough? (Dealbook)

Ben Bernanke leads the most profitable bank in the world. (Pragmatic Capitalism)

Can Goldman Sachs ($GS) and Morgan Stanley ($MS) earn back investor confidence? (Term Sheet)

The state of the search for MF Global customer cash. (Dealbook)

What passes for research these days on Wall Street. (I Heart Wall Street)

ETFs

Don’t buy a high dividend ETF if it does not have some criteria for sustainability. (IndexUniverse)

Stop blaming leveraged ETFs for market volatility. (Focus on Funds)

How you index matters. (research puzzle pix)

Another sign that self-indexing is the new thing for ETFs. (IndexUniverse)

Hedge funds

What happens when hedge funds stop self-reporting to industry databases. (Buttonwood)

How much the top hedge funds made in 2011. (FT Alphaville, Dealbreaker)

Global

European stocks, specifically large caps, are too cheap to ignore. (Marketwatch, FT Alphaville)

The Euro is the new carry trade funding currency of choice. (FT)

Demand for safe assets continues to complicate central banking. (FT Alphaville)

Will the Euro survive 2012? (Curious Capitalist)

Europe and the US continue to diverge. (Calafia Beach Pundit)

Economy

Small business optimism is on the rise. (Real Time Economics, Calculated Risk)

More part-timers are making the switch to full-time work. (Bloomberg)

Another sign a recession is not coming in 2012. (Bespoke)

Still no signs of inflation on the horizon. (Pragmatic Capitalism, Curious Capitalist)

The Fed does not have a “create inflation” button. (Money Game)

Earlier on Abnormal Returns

Decent returns beat no returns at all. (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

Failure is not a four-letter word. (Points and Figures)

Abnormal Returns is a founding member of the StockTwits Blog Network.