Quote of the day

John Kay, “So the business leaders of today are not capitalists in the sense in which Arkwright and Rockefeller were capitalists. Modern titans derive their authority and influence from their position in a hierarchy, not their ownership of capital.” (John Kay)

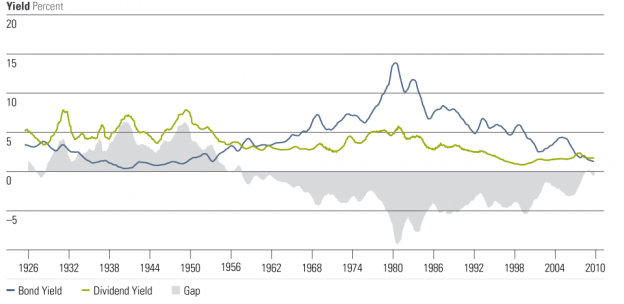

Chart of the day

The long history of bond yields vs. dividend yields. (Morningstar)

Markets

The Wilshire 5000 is nearing new highs. (Crossing Wall Street)

Markets are still betting on relatively high European equity volatility. (Condor Options)

It’s all about initial unemployment claims this year. (Dr. Ed’s Blog, Marketblog)

Who is buying esoteric ABS these days? (Finance Addict)

Strategy

The interest rate environment is shifting. What next? (Market Anthropology)

A truly inefficient market is hard to find. (Total Return)

Never average down. (Joe Fahmy)

Companies

Don’t confuse today’s Microsoft ($MSFT) with Microsoft from a decade ago. (Big Picture)

The simple bull case for Lululemon ($LULU). (Kid Dynamite)

A look at two decades of Ford ($F). (research puzzle pix)

CEOs

How much does a CEO really need to be incentivized? (Deal Journal)

Narcissistic CEOs kill companies. (Eric Jackson)

Don’t e-mail a Wall Street CEO over New Year’s. (Clusterstock)

Real estate

Office rents are going to keep coming down, while storage facilities continue to boom. (Calculated Risk, WSJ)

Lehman Brothers is still alive and doing deals. (Dealbook)

Where will mortgage REIT yields bottom out? (Fortune)

Finance

What does Wall Street do for you? (Planet Money)

Banks, like Bank of America ($BAC), are the ultimate hedge against an upside surprise. (Deal Journal)

Europe has a pension problem. (Bloomberg)

Hedge funds

Hedge funds have no shortage of excuses for their poor performance last year. (Reuters)

Guess who is set to win if Greece gets bailed out again? (NYTimes)

Do hedge fund clones work? (AR+Alpha)

ETFs

ETFs that have $10 billion in AUM. (ETFdb)

Looking for a better way to hedge market volatility. (Sober Look)

The menu of limited volatility ETFs continues to grow. (VIX and More)

Economy

The Fed has kept the bond vigilantes at bay for quite some time. (MarketBeat)

Wages really haven’t fallen amidst the Great Recession. (Economist’s View)

The US still has plenty of room to reduce oil consumption. (Econbrowser)

Earlier on Abnormal Returns

Big ETFs likely to keep on getting bigger. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Americans are eating less meat. (Mark Bittman, Wonkblog)

Even the smartest people in the world make (big) mistakes. (Falkenblog)

Abnormal Returns is a founding member of the StockTwits Blog Network.