Quote of the day

Cullen Roche, “Human beings just aren’t built for life in the markets. We are built to survive. That’s why controlling your emotions is the #1 hurdle in the markets.” (Pragmatic Capitalism)

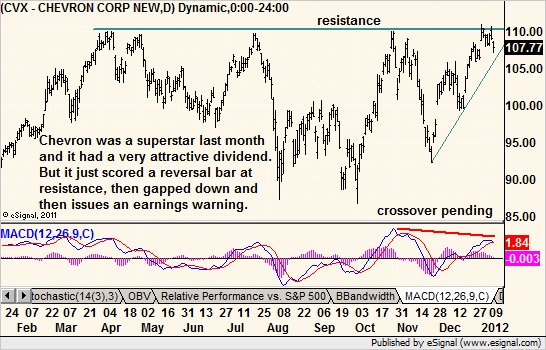

Chart of the day

Chevron ($CVX) has a resistance problem. (Minyanville)

Markets

The percentage of stocks trading above their 200 day moving average keeps ticking higher. (@jackdamn)

A sign that investor sentiment has gotten a tad bullish. (Bloomberg, Bespoke)

While investors continue to pull assets out of equity mutual funds. (The Reformed Broker)

The economic surprise cycle is going to have to turn. (MarketBeat)

Strategy

Non-linearities, data mining and building a $VIX-based investment model. (EconomPic Data)

Can technical analysis work if markets are being distorted by intervention? (Behind the Headlines)

Do hedge fund investors really understand what they are getting? (IndexUniverse)

Skyscrapers, stadium naming rights and the toll of hubris. (SurlyTrader)

Companies

Sometimes a technology company simply misses the next wave and fails. (FT)

Signs that Apple ($AAPL) earnings are going to look pretty good. (GigaOM, Apple 2.0)

Finance

VCs need IPO exits. (Institutional Investor)

Little sign that de-equitization is ending any time soon. (FT Alphaville)

Time to start learning more about banks’ “deferred tax assets.” (FT Alphaville)

No offense Warren, but what the heck are you talking about? (Kid Dynamite, Time)

Private equity

Like it or not, we are all private equity investors. (WSJ)

No wonder so many ex-politicians feel the pull into private equity. (Forbes)

Is private equity good for America? (The Atlantic)

Global

Emerging markets would not be immune from further Euro shocks. (FT)

Liquidity conditions seem to be easing in Europe. (Calafia Beach Pundit)

Can Italy live with 7% bond yields? (Globe and Mail, MarketBeat, FT Alphaville)

Economy

Weekly initial unemployment claims jumped up to near 400,000. (Bespoke, Calculated Risk, Capital Spectator)

Retail sales are still growing 6% year-over-year. (Calculated Risk, ValuePlays)

In search of better leading economic indicators. (A Dash of Insight)

When will the Fed begin raising rates again? (Free exchange, Finance Addict)

On the benefits of a mass mortgage refinancing program. (Liberty Street)

The natural gas market has a fundamental problem. (WSJ, Bespoke)

Earlier on Abnormal Returns

On the parallels between art and hedge fund investing. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Books

Four questions for Joe Terranova author or Buy High, Sell Higher: Why Buy-And-Hold Is Dead And Other Investing Lessons from CNBC’s “The Liquidator”![]() . (The Reformed Broker)

. (The Reformed Broker)

In praise of Carl Richards’ The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money![]() . (Forbes)

. (Forbes)

Abnormal Returns is a founding member of the StockTwits Blog Network.