Question of the day

Who brings eggs to an Apple Store in anticipation of the iPhone 4S launch? (WashingtonPost)

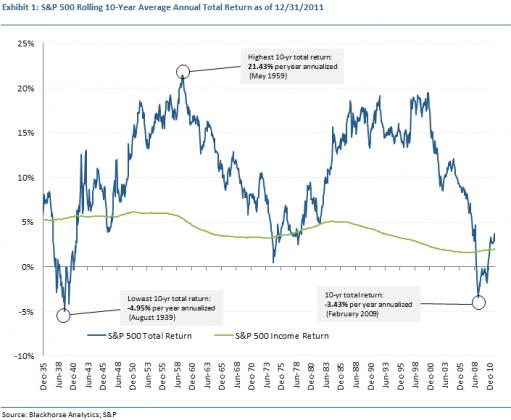

Chart of the day

A nice look at 10-year rolling real S&P 500 total returns. (Quant Monitor)

Markets

Does the market care about three day weekends? Apparently not. (CXO Advisory Group)

What happens to equities when bonds experience outsized returns. (Timely Portfolio)

When sentiment indicators disagree. (Humble Student of the Markets)

Three sectors have led the market in 2012. (Market Montage)

Short term volatility is oversold. (Investing With Options)

2011 was a tough time for momentum-based TAA strategies. (Systematic Relative Strength)

Companies

No matter how you slice it Microsoft ($MSFT) looks safe and cheap. (Turnkey Analyst)

Netflix ($NFLX) now look more like a normal company. (YCharts Blog)

Do airline mergers ever work? (Deal Journal)

Finance

Four takeaways from JP Morgan ($JPM) earnings. (MarketBeat also NetNet)

No wonder companies hate defined pension plans. As interest rates fall the funding gap widens. (Total Return)

Your view of private equity all depends on where you stand. (WSJ)

Ken Griffin’s fund has come all the way back from a disastrous 2008. (Dealbook)

ETFs

Junk bond ETFs are big enough to roil the high yield market. (Bloomberg)

More low volatility ETFs are launching, now the emerging markets and developed market are covered. (IndexUniverse)

Global

Two AAA-rated European nations are reportedly set for a downgrade. (FT, MarketBeat)

Chinese inflation is decelerating. (Econbrowser, Dr. Ed’s Blog)

The RICs come out pretty out cheap on the Big Mac Index. (Economist)

To save the Euro you have to plan for its demise. (FT)

Tracking the European economy in real time. (Free exchange)

Is it better to be Latvia or Argentina? (Fortune)

Economy

This model shows no sign of recession on the horizon. (A Dash of Insight)

Consumer confidence is highly correlated with the stock market. (Money Game, Calculated Risk)

Is the drop in the US labor participation rate permanent? (Gavyn Davies)

Economics needs to get back to its political economy roots. (Economist)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Magnus Carlsen, “Having preferences means having weaknesses.” (ChessBase via kottke)

Abnormal Returns is a founding member of the StockTwits Blog Network.