Quote of the day

Tyler Craig, “Over time as earnings seasons come and go, one overriding truth becomes apparent – earnings announcements are the playground for degenerate gamblers.” (Tyler’s Trading)

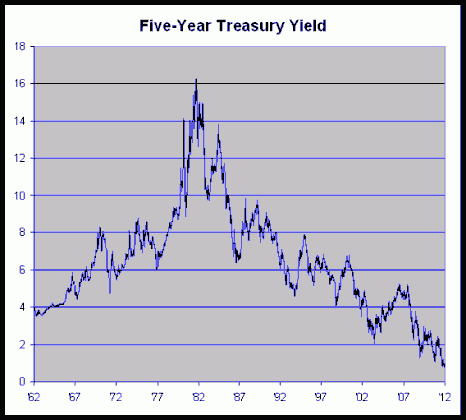

Chart of the day

The 5 year Treasury note is trading at an all-time low low yield. (Crossing Wall Street)

Bonds

Investors can’t get enough muni bond funds. (FT, Bond Buyer, MarketBeat)

Three reasons to own Treasury bonds. (WSJ)

Keep an eye on high yield bond issuance. (Sober Look)

Doubleline Capital is attracting assets at a healthy clip. (Clusterstock)

Markets

Stop trying to pin market moves on the gyrations in the Presidential campaign. (Barry Ritholtz)

From a sector perspective 2012 looks a lot different than 2011. (All Star Charts)

Dr. Copper has reportedly moved his/her practice to China. (WSJ)

Some brokers no longer want smaller accounts. (NYTimes)

Strategy

There is no such thing as an emotion-free trader. (Derek Hernquist)

How to think about analyst earnings estimates. (WSJ)

In defense of hedge fund cloning. (World Beta)

For all you Barron’s Roundtable fans, part one. (Barron’s)

Companies

Should auditors have term limits? (Jason Zweig)

iPad 3 is coming and it sounds cool. (Bloomberg)

Why did Eastman Kodak ($EK) fail while Fujifilm survive? (Economist)

ETFs

Always look beyond an ETF’s label. (IndexUniverse)

Low volatility ETFs come in three distinct flavors. (VIX and More)

Global

France and Austria lose their coveted AAA-ratings. (WSJ, FT, NYTimes)

Felix Salmon, “Europe’s a risky continent; S&P is simply making that fact a little more obvious.” (Reuters)

More reactions to the divergence in European debt ratings. (Free exchange)

Is there a speed limit on global economic growth? (Free exchange)

Economy

The ECRI WLI is trending down again. (MarketBeat)

2012 as the start of a housing recovery. (Sober Look)

Earlier on Abnormal Returns

What you may have missed in our Saturday long form linkfest. (Abnormal Returns)

Top clicks this week on Abnormal Returns. (Abnormal Returns)

Mixed media

A review of Simon Lack’s The Hedge Fund Mirage: The Illusion of Big Money and Why It’s Too Good to Be True![]() . (Aleph Blog)

. (Aleph Blog)

Happy fifth blogiversary to Bill. (VIX and More also Barron’s)

The CNBC-ification of Bloomberg TV. (The Basis Point)

Abnormal Returns is a founding member of the StockTwits Blog Network.