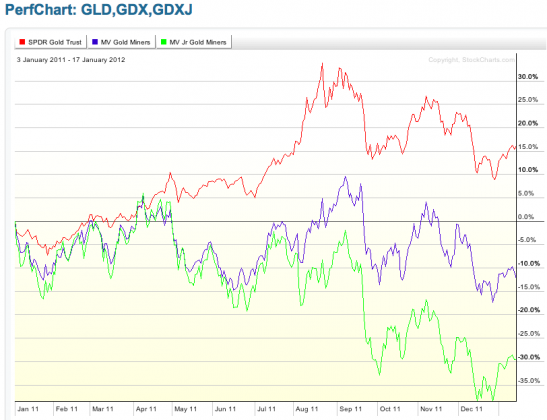

Sometimes it is worth reviewing a concept every one seemingly already knows. Today the fact that the stock in gold miners is not the same thing as gold itself. A quick look at the chart of gold ($GLD) versus two flavors of gold miners ($GDX and $GDXJ) since the beginning of 2010 shows pretty clear the fact that the performance of the shiny metal and the equity of the gold miners can diverge significantly (in both directions) and for longer than most believe.

Source: StockCharts.com

There is another factor always at play when it comes to the gold miners and miners in general: political risk. Or maybe more precisely stated expropriation risk. If a foreign miner invests a great deal of capital into a mine, the one thing they can’t do is up and move that mine to a more favorable locale. Therefore in countries where the rule of law is tenuous, at best, there is always the risk the miner loses their mine forcibly or by other less drastic means.

Robert Johnson and Divya Reddy in a post at beyondbrics today look at this very phenomenon. They write:

Geologically-attractive deposits (especially for gold, and to a lesser extent, copper) in politically-stable countries are scarce today, while large, untapped deposits in frontier markets offer greater promise. However, this shifts risks from below- to above-ground. The world should brace itself for an increase in supply disruptions for key commodities.

Unfortunately for resource investors there is not likely to some great discovery of untapped metal resources in capital-friendly developed countries any time soon. They continue:

Frontier markets are characterised by the absence of strong political institutions and a paucity of earlier major natural resources investment. Compared to the Bric nations and more established emerging markets, the frontier nations are generally beset by more severe poverty and deeper social cleavages, through ethnic, regional, or sectarian disputes.

In short, don’t expect the political risk facing miners of all types to go away any time soon. On the face of it things like gold and gold miners should be interchangeable. In fact they are two very different types of investments. Make sure you understand the difference.

Recent gold items worth a look:

Political risk in mining. (beyondbrics)

Dikembe Mutombo: failed Congolese gold broker. (Kid Dynamite)

Gold supply/demand over time. (Money Game)