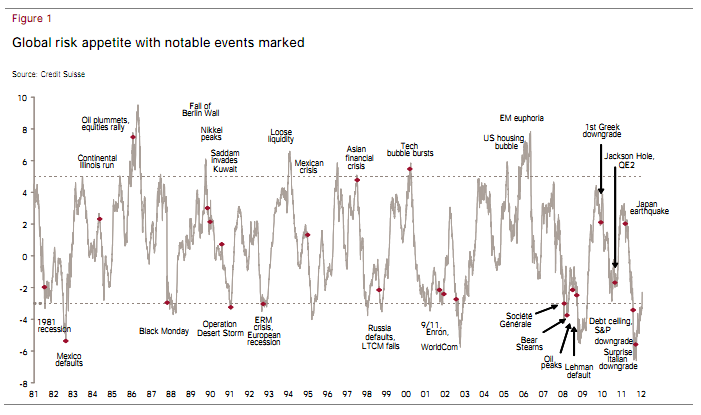

The brand new Credit Suisse Global Investment Returns Yearbook 2012 is out!* This is a must-download for any one seriously interested in investing. In addition to the great data it provides there are also some in-depth articles from Dimson, Marsh and Staunton. In one piece they look at the ability of various asset classes to hedge inflation. In another article they look at the benefits (or not) of currency hedging in international investing. Lastly McGinnie and Wilmot look examine risk appetites through the lens of the Credit Suisse Global Risk Appetite Index (GRAI) which you can see it below:

Source: Credit Suisse

In addition there is a bunch of country level return data as well. In short, this document is a must-read. Sell-side research comes in for a lot of criticism of late from all corners of the blogosphere. However a document like this shows that there still is some great research being produced. And the price is right. You can thank me later for the recommendation….

*Hat tip: The Source