Quote of the day

Farhad Manjoo, “Honeywell seems to have patented a bunch of great ideas in order to just sit on them.” (Slate)

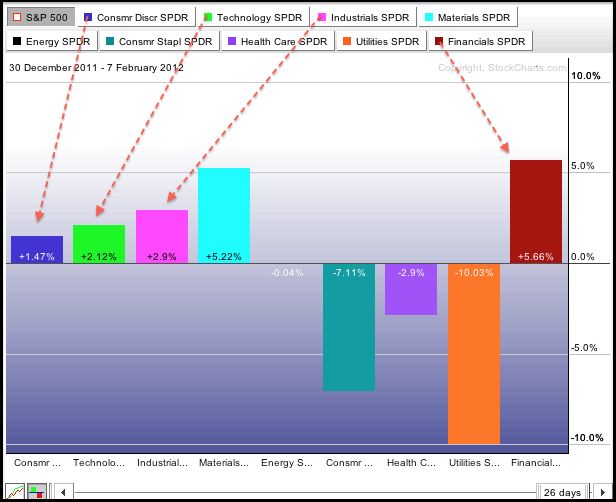

Chart of the day

Risk on! Offensive sectors lead the market higher. (StockCharts Blog)

Markets

Does a falling earnings beat rate presage an earnings peak? (Crossing Wall Street)

A long term model of S&P 500 valuations points to fair valuation. (EconomPic Data)

Larry Fink may have misspoken when he said go to “100% equities.” (MarketBeat, ibid, Bloomberg)

Volatility

It’s business as usual for the $VIX. (VIX and More)

Check out the gap in implied volatilities. (SurlyTrader)

A friendly reminder that the $VXX is but a trading vehicle. (Adam Warner)

The Dow

Why do we still care about the Dow? (NYTimes)

Dow Theory adherents are on pins and needles. (Big Picture, MarketBeat)

Natural gas

Natural gas may have bottomed, but finding a good play is tough. (Peter L. Brandt)

$UNG may be the “worst investment in the world.” (Dan Dicker)

Check out the surge in natural gas futures contracts outstanding. (FT Alphaville)

Strategy

A market timing rule that actually works. (Falkenblog)

Is there really such a thing as a “permanent portfolio.” (research puzzle pix)

On the difference between “risk capacity” and “risk tolerance.” (Morningstar)

Why models need to be augmented with “common sense and experience.” (HistorySquared)

Paul Kaplan’s Frontiers of Modern Asset Allocation![]() is not for beginners. (Reading the Markets)

is not for beginners. (Reading the Markets)

Companies

Facebook governance critics should check their outrage at the door. (Dealbreaker also Term Sheet)

Apple ($AAPL) is looking for partners in its TV program. (GigaOM, SplatF)

Miners have not typically been vertically integrated, Glencore-Xstrata hopes to change that. (FT, Deal Journal)

Finance

It is hard to buy tail risk insurance if no one is selling. (FT also Finance Addict)

What is capital structure arbitrage? (Distressed Debt Investing)

Should the SEC allow ‘mini-float’ IPOs, like Caesars Entertainment ($CZR)? (WSJ, Term Sheet, 24/7 Wall St., Breakingviews, Kid Dynamite)

On the safe asset shortage. (FT Alphaville, Real Time Economics)

The best disclaimer language ever. (Big Picture)

ETFs

The relationship between ETF providers and index firms is becoming “more complex.” (FT)

ETFs, by and large, avoid the issue of fees on fees. (ETF Replay)

Permanent portfolios come to the world of ETF fund of ETFs. (IndexUniverse, ETFdb)

Global

The downside of the German “jobs miracle.” (Reuters)

Is QE still working? (Gavyn Davies)

Economy

The rebounding US economy is being led by oil & gas and manufacturing. (WSJ, ibid)

Job openings are on the rise. (Capital Spectator)

Deleveraging is history. (Calafia Beach Pundit)

The virtual ‘app economy‘ creates real jobs. (Mike Mandel)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Do multiple monitors actually increase efficiency? (NYTimes)

Ratings systems always end up getting scammed. (Crooked Timber)

The economics of the big ski resorts. (The Atlantic)

Abnormal Returns is a founding member of the StockTwits Blog Network.