Quote of the day

Gary King, “But the march of quantification, made possible by enormous new sources of data, will sweep through academia, business and government. There is no area that is going to be untouched.” (NYTimes)

Chart of the day

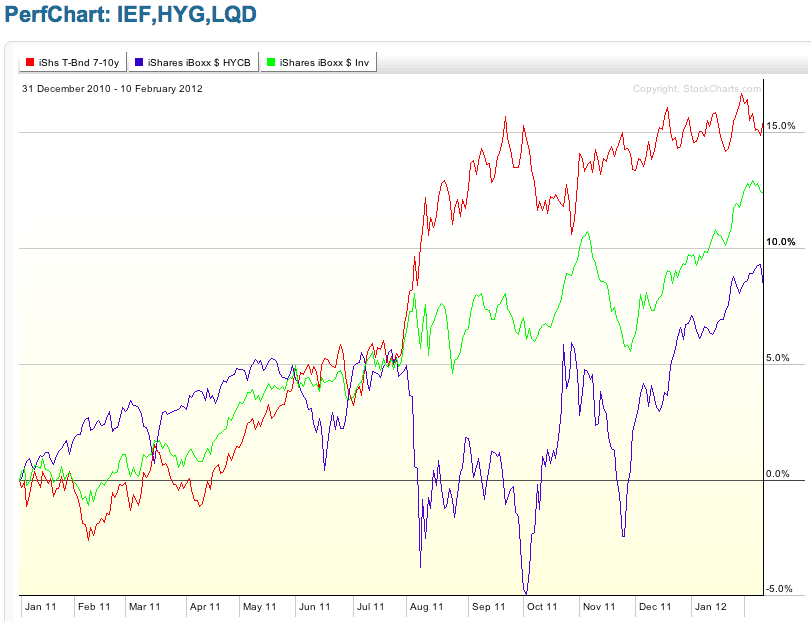

Are high yield bonds cheap or dear? (Aleph Blog)

Markets

Everyone is talking about this Dow 15,000 call. (Barron’s also Money Game)

It is going to more than a few too many bears to turn this market. (Dynamic Hedge)

Rydex traders are particularly bullish. (The Technical Take)

What is up? Despite better economic conditions, earnings estimates are falling. (Money Game)

A weird week in which the $VIX decoupled from the stock market. (VIX and More)

Strategy

Investors seem to be surprisingly myopic when it comes to analyzing market trends. (Jason Zweig also TRB)

Stock investing is not as easy as Warren Buffett makes it out to be. (Bronte Capital)

You can’t thrive in the markets, if you don’t survive. (Kirk Report)

Relative strength and portfolio management. (SSRN via MoneyScience)

Selling calls is the new black. (Barron’s)

Using history to outline the worst case scenario for clients. (Financial Adviser via TRB)

Companies

Apple’s ($AAPL) line of notebooks is going to get MacBook Air thin. (AppleInsider)

There is room in the tablet market for Microsoft ($MSFT). (Pando Daily)

Why Oracle ($ORCL) really might be doomed this time. (Pando Daily)

Finance

Goldman Sachs ($GS), the Fed, Maiden Lane and the Volcker Rule. (Dealbreaker)

A Tobin tax is not the first line method of fixing broken markets. (Points and Figures)

The SEC is sniffing around the private equity industry. (WSJ)

Another example of the home bias at work: lending. (voxEU via EV)

ETFs

Not all ETF spreads are created equal. (Focus on Funds)

Everybody and their brother wants to be called an ETF these days. (Barron’s)

Price competition at work in the world of ETFs. (FT)

Economy

Disability claims are taking the place of unemployment benefits for many. (Sober Look)

Food trends: cattle demographics shift and companies are having trouble finding enough coconuts. (WSJ, ibid)

Why we need a simpler, expanded version of I Savings Bonds. (Interfluidity)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you missed in our Saturday long form linkfest. (Abnormal Returns)

Business

Why Mark Zuckerberg should ignore the management consultants. (Felix Salmon)

The pendulum is once again swinging toward more open work spaces. (Gillian Tett)

Mixed media

Why do zebras have stripes? The answer will likely surprise you. (Economist)

If you equate time with money you are less likely to enjoy your time off. (Scientific American)

Quantity vs. quality online. (Felix Salmon)

Jeremy Lin is no fluke. (FiveThirtyEight, Marginal Revolution)

Abnormal Returns is a founding member of the StockTwits Blog Network.