Quote of the day

Howard Marks, “Thus timing – and in particular the selection of the beginning point and end point for studying a performance record – plays an incredibly important role in perceptions of success or failure.” (World Beta)

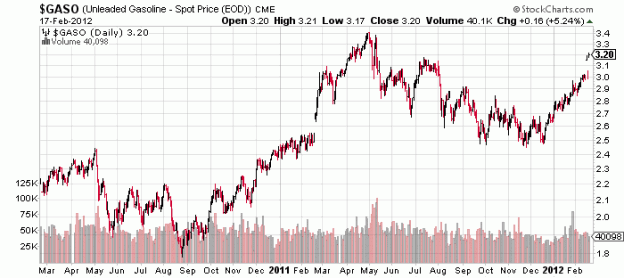

Chart of the day

Higher unleaded gasoline prices threaten the recovery. (Pragmatic Capitalism)

Markets

Energy stocks are beginning to show some relative strength. (StockCharts Blog)

In what state will the market be when the next surprise hits? (Dynamic Hedge)

On the absurdity of negative real yields on Treasuries. (Sober Look also Calafia Beach Pundit)

The stock-bond anomaly keeps growing in 2012. (Money Game)

Checking in on bullish investor sentiment. (The Technical Take)

Strategy

Are you diversified? Less than you think. (Jason Zweig)

When the market moves against you, first admit you have a problem. (The Reformed Broker)

Time to start thinking about a stock replacement strategy. (Barron’s)

How to invest in spinoffs. (Globe and Mail)

Why study bad companies? (Old School Value)

Companies

What’s the plan to turn Hewlett-Packard ($HPQ) around? (Barron’s)

Apple ($AAPL) is not as cheap as you think it is. (Bloomberg)

Why alternate payment systems are having a hard time making inroads against the credit card companies. (Pando Daily)

Finance

Complex mortgage securities are once again finding willing buyers. (Dealbook)

The Facebook IPO will not unleash a follow-on wave of IPOs. (WashingtonPost)

US Bancorp ($USB) joins the ETF game already in progress. (Focus on Funds)

America’s schizophrenic banking system. (FT)

Community banks are getting their own SecondMarket. (Felix Salmon)

Hedge funds

What good are hedge funds? (Marginal Revolution)

Smaller hedge funds have a better chance of outperforming in this sort of environment. (Bloomberg)

Ray Dalio sold a chunk of Bridgewater Associates. (Bloomberg, Deal Journal)

Global

China cuts reserve requirements for its banks. (NYTimes)

Checking in on the German “economic miracle.” (Bonddad Blog)

Canada’s housing market is at risk of “severe correction.” (Financial Post via @frankvoisin)

Supranational corporations are the new multinationals. (Finance Addict)

Economy

A look at the stock-driven leading economic indicators. (EconomPic Data)

Five cents of every retail dollar is spent online. (Real Time Economics)

The surge in temporary jobs reflects a new reality for the jobs market. (WashingtonPost)

Measuring the output gap is tougher than it looks. (Economist’s View, Sober Look)

President Obama, we need better economic data. (Real Time Economics)

Regulation in America: “Complexity costs money.” (Economist, ibid)

Earlier on Abnormal Returns

Top clicks this week on Abnormal Returns. (Abnormal Returns)

What you missed in our Saturday morning linkfest. (Abnormal Returns)

Mixed media

Why do we form habits? So we can use our brains for unpredictable events. (Jonah Lehrer)

John Fairfax lived an interesting life, to say the least. (NYTimes)

Abnormal Returns is a founding member of the StockTwits Blog Network.