Quote of the day

Jim Paulsen, “It is time for the Fed to shake off its ‘crisis mindset’ and begin to normalize its remarkably accomadative monetary policy, The U.S. economy is no longer in crisis, but rather in a recovery which appears to be gearing and sustaining.” (MarketBeat)

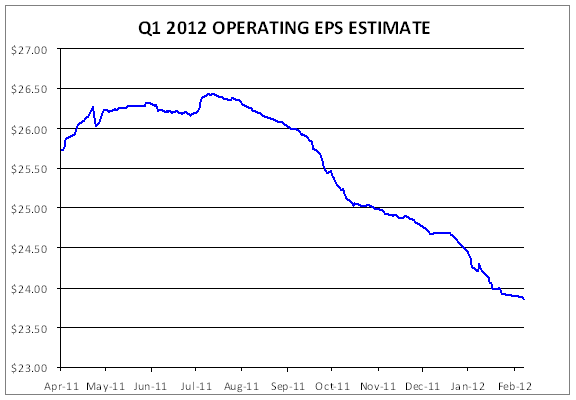

Chart of the day

Q1 earnings estimates keep coming down. (Crossing Wall Street)

Markets

The wall of worry detailed. (Time also FT Alphaville)

What can you learn by watching utilities. (StockCharts Blog)

A look back at the biggest one day spike in the $VIX. (VIX and More)

Strategy

Be wary of predictive mutual fund ratings. (Marketwatch)

The best of both worlds: invest in the local affiliates of mulitnational companies. (beyondbrics)

Do satisfied employees make for a better stock price? (Turnkey Analyst)

More Buffett stuff

Warren Buffett has picked a successor, but who is it? (WSJ, Finance Addict, Marketplace, Breakingviews)

Warren Buffett’s number one investment idea. (Money Game)

J.P. Morgan ($JPM) reside in Buffett’s personal portfolio. (24/7 Wall St.)

Felix Salmon, “The only real difference between a bolt-on and a tuck-in is that a bolt-on sounds bigger and more important.” (Reuters)

Warren Buffett distilled. (CXO Advisory Group)

Technology

Why Eric Schmidt may want to accelerate his Google ($GOOG) share sales. (YCharts Blog)

Rising competition for Apple ($AAPL) in smartphones. (NYTimes)

The upside of the Linked ($LNKD) story. (The Reformed Broker)

Online file backup and synching, i.e. Dropbox, is a feature not a product. (Farhad Manjoo)

Companies

Blackstone Group ($BX) wants to help export US natural gas. (Dealbook)

It’s good to be a commodity chemical maker in the US these days. (WSJ)

Five reasons for the downfall of Eastman Kodak. (The Source)

Finance

The pros and cons of stock buybacks. (WSJ also Money Game)

Hello bank dividends. (Deal Journal)

Can LPL Holdings ($LPLA) win the “battle for advice”? (research puzzle pix)

Investigators are hopefully getting closer to sorting out MF Global wire transfers. (Dealbook)

The FBI is serious about this whole insider trading thing. (Dealbreaker)

ETFs

Not every ETF on “deathwatch” goes away. (Focus on Funds)

How to create a “total economy portfolio” using ETFs. (Rick Ferri)

For what investors will the new Pimco Total Return ETF ($TRXT) make sense price-wise. (Forbes)

Like locusts investors are jumping into $UVXY. (IndexUniverse)

A look at the new sector bond ETFs. (ETFdb)

Global

While inevitable investors should be afraid of a “Grexit.” (Economist, Free exchange)

It’s LTRO week in Europe. (WSJ, FT Alphaville)

Portugal is going to be a problem in 2013. (FT Alphaville)

Where does the BOJ want the Yen to go? (The Atlantic)

Canada’s housing bubble has gone mainstream. (MacroBusiness)

The coming economic collapse in China. (Time)

Economy

Why you should look for a strong NFP number. (Stone Street Advisors)

Is ECRI paying attention to it’s own indicators? (dshort)

Manufacturers may have to begin hiring once again. (Slate)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Deemer on Technical Analysis: Expert Insights on Timing the Market and Profiting in the Long Run![]() is not your typical technical analysis book. (Reading the Markets)

is not your typical technical analysis book. (Reading the Markets)

A great way to kill your startup: listen to your customers. (The Atlantic)

Abnormal Returns is a founding member of the StockTwits Blog Network.