Quote of the day

Derek Thompson, “The recovery has been a drag because housing has provided a monstrous anchor, dragging down construction, local tax revenues, service jobs, entrepreneurship, credit availability and overall spending.” (The Atlantic)

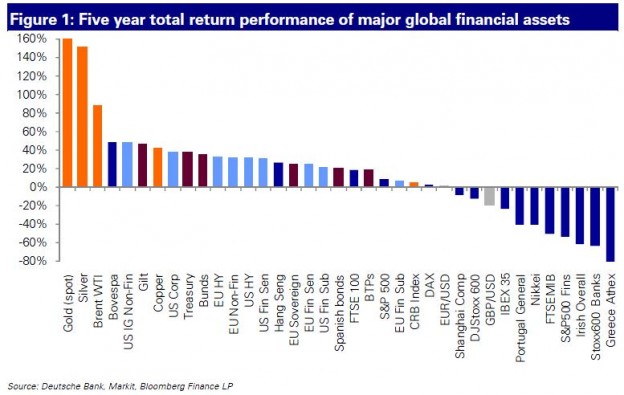

Chart of the day

Five year asset class returns. (FT Alphaville)

Markets

Opposing views on the market from two value managers. (Frank Voisin)

Ten high conviction buys from ultimate stock pickers. (Morningstar)

When will we get back to a normalized world of asset class returns? (Minyanville)

Comparing the returns on leveraged loans vs. high yield bonds. (Total Return)

Too many investors have jumped the gun trying to catch a bottom in natural gas. (All Star Charts also Bespoke)

Strategy

If you are losing money in this market you may need to rethink things. (bclund)

Buy growth stocks after bullsh*t downgrades. (The Reformed Broker)

The odds are stacked against you picking a manager who consistently outperforms the market. (Bucks Blog)

How much have investors lost by pulling out the stock market? Putting a number on the size of the behavior gap. (SmartMoney)

Are overconfident CEOs better innovators? (Journal of Finance)

Investors like foreign companies that list their shares in the US. (Institutional Investor)

Companies

TransCanada ($TRP) is pushing forward on the US Gulf part of the Keystone XL oil pipeline. (WSJ, The Atlantic)

The drivers of Fastenal ($FAST) stock. (YCharts Blog)

How big a hit are banks going to take from the sinking tanker industry? (FT Alphaville)

Berkshire Hathaway

What is Berkshire Hathaway ($BRKA) worth? (Geoff Gannon)

More thoughts from the Berkshire Hathaway annual report. (Aleph Blog)

Technology

Why hasn’t OpenTable ($OPEN) service gotten much better over time? (Felix Salmon)

Yahoo! ($YHOO) claims Facebook is infringing on its patents. (Dealbook, Eric Jackson)

The pending IPO has not stopped investors from trying to grab Facebook shares now. (WSJ)

The state of the Mac business. (ReadWriteWeb)

Horace Deidu, “HP’s operating margin for PCs is 5% while Apple’s is 21%.” (Asymco)

Finance

It is good to have Uncle Sam as a big shareholder. The case of AIG ($AIG). (NYTimes)

High frequency trading isn’t going away any time soon. (Term Sheet)

The New York pension fund is lending to its own localities. What could possibly go wrong? (NYTimes, Buttonwood, Kid Dynamite)

Economy

A surprising drop in January durable goods. (Calculated Risk also Money Game, Capital Spectator, EconomPic Data, Sober Look)

Regional Fed surveys point towards continued growth. (Capital Spectator)

Consumers are beginning to feel the economic recovery. (MarketBeat, TRB)

Why it’s different this time when it comes to gasoline prices. (Money Game)

Little sign of a bottom in housing from Case-Shiller data. (Calculated Risk, Big Picture, Planet Money)

There is little evidence the Fed is pushing commodity prices higher. (Econbrowser)

How much do taxes matter to the really rich? (Baseline Scenario, Modeled Behavior)

Earlier on Abnormal Returns

Andrew Lo on “diversification deficit disorder.” Managing portfolios in an age of volatile volatility. (Abnormal Returns)

What you missed in our Tuesday morning linkfest. (Abnormal Returns)

Mixed media

There are deep seated reasons why good looking people make more money. (James Surowiecki)

What explains the male marriage premium? (EconLog)

Save recess! (The Atlantic)

We still don’t know much about how anesthesia works. (Scientific American)

Abnormal Returns is a founding member of the StockTwits Blog Network.