Quote of the day

“Perhaps the S&P 500 will keep rising this year. But if it does, it won’t be because the index is dirt cheap.” (Buttonwood)

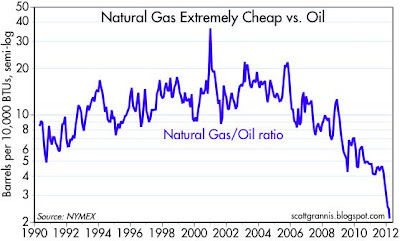

Chart of the day

Seismic shifts in the natural gas/oil ratio will restructure the economy. (Calafia Beach Pundit)

Markets

Another look at the Treasury curve ‘accordion.’ (research puzzle pix)

What companies belong to the $100 billion club? (Bespoke)

Bearish sentiment is picking up. (MarketBeat, Bespoke)

Strategy

Time frames matter. (Stock Sage)

Why you should pay attention to volume. (Tyler’s Trading)

The future for retail investors is institutional grade asset allocation solutions. (AdvisorOne)

Companies

People will always eat Cheerios, hence General Mills ($GIS). (Phil Pearlman)

Just how far has computing come in the past four years: the Apple ($AAPL) example. (Asymco)

What company can be ‘the Apple of consumer credit’? (Ben Weiss)

So giving away music for free doesn’t generate profits? The case of Pandora ($P). (Time)

Companies should listen to their employees, not consultants. (Aleph Blog)

Finance

Why LPs want to be GPs. (Institutional Investor)

Apollo Global Management ($APO) wants to be the “new bank.” (Bloomberg)

Exchanges

Why volume is getting shunted into dark pools. (Term Sheet)

Forex trading volumes have dropped off the table as traders shun the Euro. (FT)

The exchanges are beginning to push back against high frequency traders for clogging the quote pipeline. (FT)

IPOs

If you are NOT a part of the Facebook underwriting syndicate raise your hand. (Deal Journal)

Let the battle of headline writers begin, Fender files for an IPO. (peHUB, Bloomberg, Deal Journal)

Hedge funds

Hedge funds are off to a good start. (Dealbook)

The long and winding road for hedge fund manger Stephen Czech. (WSJ)

What Bill Ackman likes in the retail space. (Market Folly)

Bankruptcy

Finding value in Lehman Brothers bonds. (Distressed Debt Investing)

Why retailers don’t recover from bankruptcy. (Bloomberg)

Don’t mess with the safety of US Treasuries. (Free exchange)

ETFs

Why the $VIX is different than other “commodities.” (Condor Options, Six Figure Investing)

Another ETF first, is the WisdomTree Emerging Markets Corporate Bond ETF ($EMCB). (IndexUniverse, ETFdb)

The iShares Sovereign Screened Global Bond Fund joins the active ETF fray. (IndexUniverse)

Global

The problem with Brazil. (IndexUniverse)

Quantitative easing is wreaking havoc on pension plan shortfalls. (FT)

Yeah, the Greek debt swap is incrementally closer to actually happening. (MarketBeat)

The rally in the Norwegian krone. (The Source)

Economy

Weekly initial unemployment claims tick up. (Capital Spectator, Calculated Risk, Calafia Beach Pundit)

Why not just continue Operation Twist? (Mark Thoma, MarketBeat)

Where did the surge in consumer credit come from? (EconomPic Data)

The drop in coal traffic is holding back rail car loadings. (ValuePlays)

Earlier on Abnormal Returns

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Mixed media

A list of all of the Warren Buffetts of: _______. (Frank Voisin)

Why novelists are wary of writing about Wall Street. (Wonkblog)

Garth Sundeim’s Brain Trust: 93 Top Scientists Reveal Lab-Tested Secrets to Surfing, Dating, Dieting, Gambling, Growing Man-Eating Plants, and More!![]() sounds like a fun read. (Political Calculations)

sounds like a fun read. (Political Calculations)

Abnormal Returns is a founding member of the StockTwits Blog Network.