Quote of the day

Jason Moser, “Setbacks are opportunities to gain information and learn for the next time, so pay attention to what went wrong and get the information you need to improve.” (Scientific American)

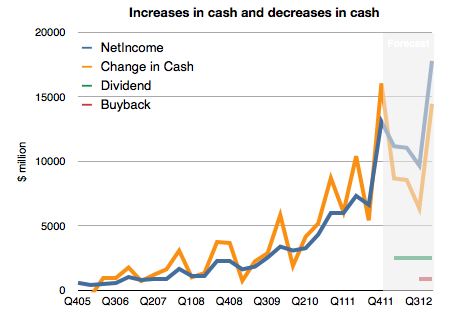

Chart of the day

Putting Apple’s cash plans into perspective. (Asymco)

Markets

Risk on: transports and small caps at new highs. (Bespoke)

Traders love to trade Apple ($AAPL) and Bank of America ($BAC) shares. (research puzzle pix)

The $VIX futures curve is record steep. Have central banks been able to tamp down on volatility? (Sober Look, The Source)

The case for palladium. (Real Time Economics)

Strategy

Calling market tops/bottoms is for suckers. (Big Picture)

Michael Sivy, “Even if Wall Street sharks refer to individual investors as muppets, there’s little they can do that will affect the long-term returns of a portfolio of well-chosen blue chips.” (Time)

On the value of dividends in investing. (Rick Ferri)

More on how one might combine value and momentum signals. (Empiritage)

Technology

Dividend or not, Apple’s cash balance should continue to grow. (WSJ, SplatF, SAI)

Wolfram Alpha is catching on. (Techland)

Roger Ehrenberg, “Selling enterprise software is like a drug. Big ticket sizes. Hefty annual maintenance charges. Heavy switching costs.” (Information Arbitrage)

Finance

Those guys as the Treasury are pretty good agency traders. (WSJ)

Seriously guys, the bank stress tests were not all that stressful. (Bloomberg)

Why one trader is quitting the CDS market. (Felix Salmon)

In defense of hedge fund herding. (Alea)

Housing

NAHB sentiment is unchanged. (Calculated Risk)

Big housing reports set for this week. (Capital Spectator)

Buy to rent: the hot new investment on Wall Street. (WSJ)

Americans continue to remodel at a healthy clip. (Calculated Risk)

On the myth of the government’s role in the subprime mortgage crisis. (Finance Addict)

Guess who is paying the bulk of the so-called $25 billion mortgage fraud settlement? Hint, it isn’t the big banks. (Economic Musings)

ETFs

A lot of funds are now all of a sudden going to have attractive three year track records. (Marketwatch)

A look at the ongoing short squeeze in the VelocityShares Daily 2x VIX Short Term ETN ($TVIX). (Sober Look)

Trade natural gas ETPs at your own risk. (Peter L. Brandt)

Global

There is always a housing bubble somewhere: now Germany. (WSJ)

About the sinking Chinese property market… (FT Alphaville)

Economy

The US consumer is not faltering. (Bonddad Blog, Humble Student of the Markets)

Is the Apple news a sign that corporate America is ready to loosen the purse strings? (Daniel Gross)

A release from the SPR is all talk to no net effect. (Econbrowser)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

Mixed media

Miguel Barbosa talks with Prof. Daniel Simons on the limits of multitasking. (Simoleon Sense)

Aggregation and curation are “the new reality of media…” (GigaOM)

Don’t follow your passion, follow your effort. (blog maverick)

Abnormal Returns is a founding member of the StockTwits Blog Network.