Quote of the day

Justin Fox, “Most of the money lost by individual investors in financial markets is lost to bad luck and poor decision-making, not inadequate accounting rules or financial regulation.” (HBR)

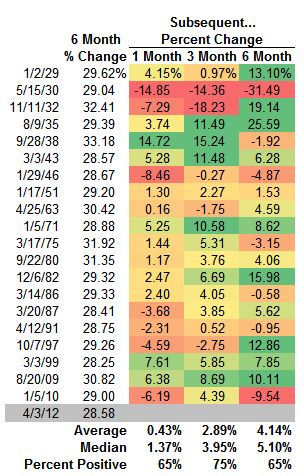

Chart of the day

What happens after the S&P 500 goes up 28% in six months. (Ticker Sense)

Markets

New meme alert: the liquidity-driven rally is over. (Money Game)

The 2007-09 bear market is officially over. (Mark Hulbert)

Can the US slough off weakness everywhere else? (Humble Student)

Sector rotation at work. (research puzzle pix)

$1.0 trillion more has flowed into bond funds vs. equity funds over the past three years. (Dr. Ed’s Blog)

There is a bull market in sand…seriously. (Climateer Investing)

Strategy

If you don’t understand delta hedging, you don’t understand options. (SurlyTrader)

If you don’t understand something, don’t invest in it. (Covestor Blog)

What happens to companies after they become the world’s largest market cap. (Market Anthropology)

Research

Performance persistence in hedge funds is real. (Sober Look)

The relationship between GDP and the stock market is pretty limited. (HistorySquared)

We assume historical stock index data is correct. We would be wrong. (Laszlo Birinyi)

Companies

Time to start paying attention to Microsoft ($MSFT) again. (Minyanville)

Constant Contact ($CTCT) is a little-known alternative to Groupon. (Businessweek)

Companies are beginning to spend their cash hoards. (Businessweek)

How executive pay gets out of control. (Reuters)

Restaurants

Burger King after a short sabbatical will be public once again. (WSJ, Dealbook, peHUB)

Overseas growth for the big restaurant companies is great but it comes at the cost of lower margins. (YCharts Blog)

Finance

Get ready for a flood of hedge fund advertising. (Fortune)

Where did all the syndicated lending go? (Felix Salmon)

IPOs

Chinese walls are coming down. (The Reformed Broker)

The whole JOBS Act is one big experiment. (Dealbook)

The problem with Groupon ($GRPN) is that is came public too soon. (Pando Daily)

No wonder companies don’t want to come public any more. (Henry Blodget)

BTG Pactual, the “Goldman of Brazil,” highlights further IPO interest. (FT, Dealbook)

ETFs

Do all natural gas ETFs lose money? (Morningstar)

Are $VIX ETPs elevating the actual VIX? (MarketBeat)

How is the Pimco Total Return ETF ($BOND) doing so far? (ETF Trends)

A look at the forthcoming Merk Hard Currency ETF ($HRD). (IndexUniverse)

ETF stats for March 2012. (Invest With an Edge)

Global

Foreign hedge funds are headed to Indian courts to assert their rights. (WSJ)

Capital continues to pour into the Canadian mining industry. (Globe and Mail)

Can the US drive world growth? (Bonddad Blog, ibid)

Economy

The March ADP report shows continued jobs growth. (Calculated Risk, Global Economic Intersection)

A weak ISM non-manufacturing report for March. (Bespoke)

Is the US in the midst of a manufacturing renaissance? (FT Alphaville)

Non-farm payrolls will hit with markets largely deserted. (MarketBeat)

Auto sales are going to add to GDP in Q1. (Calculated Risk also Daniel Gross)

Inflation will surge one of these days. Just not yet. (Capital Spectator)

Earlier on Abnormal Returns

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere is now available for the Kindle. Check it out. (Abnormal Returns)

Books

Michael Martin talks with Steve Sears author of The Indomitable Investor. (MartinKronicle)

For those who have not yet read Jack D. Schwager’s classic Market Wizards. (Reading the Markets)

An excerpt from Lynn Stout’s The Shareholder Value Myth. (The Atlantic)

Mixed media

A very special sixth blogiversary. (AlphaTrends)

Happy third blogiversary to Hunter. (Distressed Debt Investing)

In praise of Bloomberg BusinessWeek. (Marginal Revolution)

Abnormal Returns is a founding member of the StockTwits Blog Network.