Quote of the day

David Merkel, “Gold does nothing, and that’s good. We need some things in this hectic world that do nothing.” (Aleph Blog)

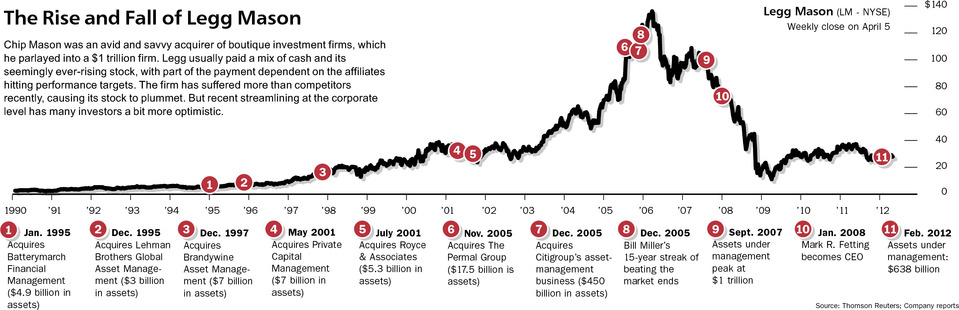

Chart of the day

The rise and fall of Legg Mason ($LM). (Barron’s)

Markets

Stocks are no longer cheap. (WSJ)

The permabears are once again having their day in the sun. (NYTimes)

Just in time for the summer, a shift in the trend of economic surprises. (Pragmatic Capitalism)

The stock market tends to rally going into Tax Day. (Barron’s)

Strategy

Dividend funds are not bonds, redux. (Jason Zweig)

How underinvested investors react in a bull market. (Phil Pearlman)

What does technical analysis mean to you? (All Star Charts)

Apple

Meet the analyst who has a “sell” rating on Apple ($AAPL). (Telegraph)

More on the potential warring factions of Apple shareholders. (Aswath Damodaran)

Is CEO Tim Cook overpaid? (Apple 2.0)

What Apple should be doing five years hence. (Xconomy)

Finance

The best hedge funds in Q1 2012. (Insider Monkey)

What the “London Whale” is likely up to. (Sober Look, FT Alphaville, Dealbook)

You can’t tell the Goldman Sachs ($GS) strategists without a scorecard. (Money Game)

According to Morningstar, Charles Schwab’s target date mutual funds are a hot mess. (InvestmentNews)

Global

Investors reaching for yield are reaching for emerging market bonds. (NYTimes also InvestmentNews)

It’s hard to tell an upbeat story about the Italian economy. (Money Game)

Euro banks are giving up on using US money market funds. (Sober Look)

Economy

Jobs market optimism has once again given way to weakness. (WSJ, Money Game, Free exchange, Tim Duy)

On second thought jobs growth was pretty good in March. (Calafia Beach Pundit, Rational Irrationality)

The ECRI WLI is growing once again. (dshort)

Have home prices hit bottom? Barry Ritholtz is skeptical. (WashingtonPost)

What the “the end of retail” means for younger workers. (The Atlantic, Money Game)

Time for the US to follow Canada and drop the penny. (NYTimes)

Earlier on Abnormal Returns

Top clicks this week on the site. (Abnormal Returns)

What you missed in our Saturday morning long form linkfest. (Abnormal Returns)

Books

The neuroscience of Bob Dylan’s genius: an excerpt from Jonah Lehrer’s Imagine: How Creativity Works. (Guardian via The Browser)

A review of Tyler Cowen’s latest book An Economist Gets Lunch: New Rules for Everyday Foodies. (WSJ, Marginal Revolution)

Abnormal Returns is a founding member of the StockTwits Blog Network.