Quote of the day

Felix Salmon, “It [Google] never really wanted to go public in the first place — it was forced into that by the 500-shareholder rule — but at this point, Google is far too entrenched in the corporate landscape to be able to turn back the clock.” (Reuters)

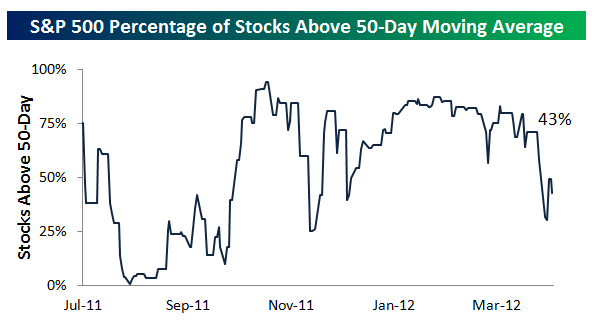

Chart of the day

Breadth has declined with energy leading the way lower. (Bespoke)

Markets

A change in tone for the market. (Downtown Trader)

Making the case that the bull market is getting long in the tooth. (Mark Hulbert)

Investors started pulling money from high yield bond funds. (Sober Look)

An inflation-adjusted look at the lost decade for stocks. (Crossing Wall Street)

Strategy

Identifying financial advisers that help more than hurt performance. (Capital Spectator)

Exploiting option information in the equity markets. (Turnkey Analyst)

What happens to the insurance industry if there is a risk-free asset shortage? (Climateer Investing)

Companies

Why did the market get the value of AOL ($AOL) patents so wrong? (Businessweek)

Why Amazon ($AMZN) is now more likely than ever to dominate the book business. (The Atlantic)

How should investors value companies with limited voting rights. (Aswath Damodaran)

Is Starbucks ($SBUX) a consumer staple or discretionary? (research puzzle pix)

Is Burger King fixable? (Fortune)

Finance

Prop trading by another name: the office of the JP Morgan ($JPM). (Bloomberg, FT Alphaville, NetNet)

Do market makers need additional incentives. The Nasdaq thinks so. (IndexUniverse)

Volume from high frequency traders has no information attached. (Macro Rants)

Inside the Paulson hedge fund complex. (Dealbook)

Funds

How mutual funds make money lending out hard-to-short securities. (Reuters)

How money managers maintain their “cultural edge.” (HBR)

Money market fund investors are getting antsy. (FT Alphaville)

The dodgier parts of the ETP industry are coming into focus. (FT)

Global

Is the correction in the Aussie dollar over? (Dragonfly Capital)

More reactions to Chinese economic growth. (Marketbeat)

Economy

Where inflation stands. (Calculated Risk)

Rail traffic is slowing. (Pragmatic Capitalism)

Are exports still a wind a the back of the US economy? (Econbrowser)

Why rents are likely to continue to increase. (The Atlantic)

Earlier on Abnormal Returns

What you missed in our Friday morning linkfest. (Abnormal Returns)

Mixed media

Historians don’t like it when non-historians drift into their arena: the case of Acemoglu and Robinson’s When Nations Fail. (Buttonwood)

Five reasons why your next “great idea” isn’t all that great. (Brian Lund)

Why digital sounds, i.e. beeps, are so annoying. (LiveScience)

Abnormal Returns is a founding member of the StockTwits Blog Network.