Quote of the day

Tom Brakke, “In a business where investors follow each other into positions, they tend not to copy successful methods.” (the research puzzle, ibid)

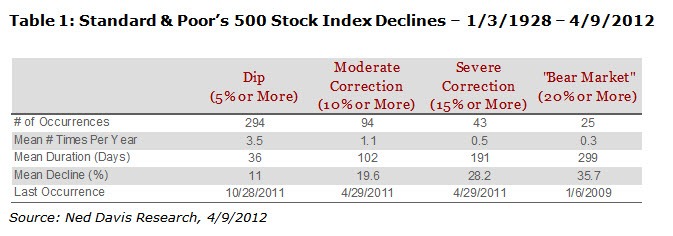

Chart of the day

The stock market dips with some regularity. The question is what are you going to do about it? (Systematic Relative Strength)

Energy

Jeff Gundlach loves natural gas. (Pragmatic Capitalism)

Why gasoline prices are dropping. (Bespoke)

Strategy

On the attractions of CTAs as an asset class. (Stock Sage)

The self-directed IRA mess: complexity, illiquidity and leverage. (WSJ)

It is clear investors are not getting the help they need. (Above the Market)

Governance

How can more than a $1 billion in loans at Chesapeake Energy ($CHK) not be “material”? (Reuters)

Shareholders: 1, Citigroup ($C) management: 0. (Dealbreaker, WSJ, FT)

Maybe the Carlyle Group should just remain private. (peHUB)

Finance

Are we over thinking what the “London Whale” is really up to? (Dealbreaker, Felix Salmon, FT Alphaville)

Another finance business, foreign money transfers, is set to be disrupted. (Pando Daily)

Mutual funds don’t want any part of CFTC registration. (WSJ)

The value of a “just say no” defense to hostile takeovers is limited these days. (Deal Professor)

An interview with Mark Gorton the head one of the biggest high frequency traders, Tower Research Capital. (HuffingtonPost)

Hedge funds

How would you describe hedge funds? (Term Sheet)

Replicating hedge fund success is no easy task. (Bloomberg)

ETFs

The five worst performing ETFs, ever. (IndexUniverse)

Comparing agriculture ETFs. (IndexUniverse)

If you don’t understand VIX products, don’t buy them. (FT)

Global

In valuation, How to take the risk of nationalization into account. (Aswath Damodaran)

Why dividends matter: the case of Australia and Japan. (MacroBusiness)

Shorting German bonds really is an asymmetric trade for John Paulson at these levels. (MarketBeat)

12 reasons why Bank of Canada chief Carney should stay put. (Globe and Mail)

Economy

The case for economic strength later in the year. (Bonddad Blog)

The AIA Architecture Billings Index shows continued expansion. (Calculated Risk)

Earlier on Abnormal Returns

What is the bottom line for financial services? (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

We recently spoke with Mick Weinstein about how we put together the site and why it is that I wrote a book. (Covestor)

Retail

Just how successful Apple Stores are. (Asymco)

How to save Best Buy ($BBY). Make it more like Costco ($COST). (Techland)

Abnormal Returns is a founding member of the StockTwits Blog Network.