Quote of the day

Eli Radke, “If you risk too much you are eventually going to realize that risk. If I keep running through traffic eventually I am going to get hit by a car.” (TraderHabits)

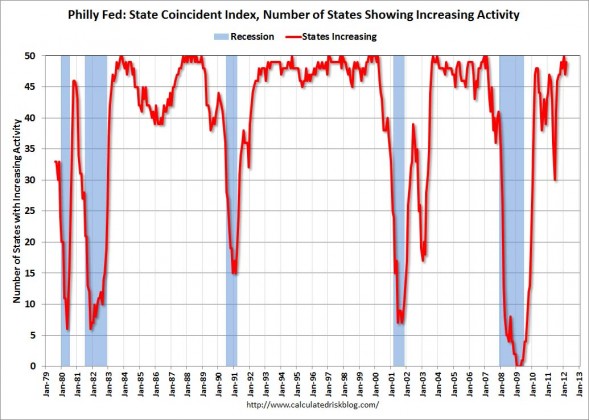

Chart of the day

For now, the economic recovery is widespread geographically per the Philly Fed Index. (Calculated Risk)

Markets

Time once again for emerging markets to shine? (Dragonfly Capital)

Another example of relative strength at work. (EconomPic Data)

Markets, including forex, are changing and traders need to adapt. (MarketBeat)

Will a more hawkish Fed ever be bullish for stocks? (MarketBeat)

US interest rates can’t fall any lower…then again. (World Beta)

Strategy

A review of the still evolving Adaptive Markets Hypothesis. (All About Alpha)

Ric Edelman, “If a fiduciary requirement requiring plain language disclosure of conflicts of interest was put in place, I bet two-thirds of mutual funds and 80% of annuities would disappear.” (LearnBonds)

Should investors bother with long/short equity mutual funds? (Focus on Funds)

Short term-oriented management have short horizon investors. (SSRN)

Trading rule number one: know what you don’t know. (Kid Dynamite)

What a technician reads. (All Star Charts)

Companies

The Apple ($AAPL) iPhone business is most profitable business in the world. (SAI)

Checking in on Apple’s valuation. (Crossing Wall Street)

Big pharma is once again on the acquisition trail. (The Source)

Ford Motor ($F) is no longer junk. (WSJ)

Why individual investors should sit out the Facebook ($FB) IPO. (Time via TRB)

A reality check on Facebook’s valuation. (Mark Hulbert)

Does the timing even matter for the Facebook IPO? (Deal Journal)

Finance

In thinly traded futures markets, like livestock, things are getting weird. (Points and Figures)

Why the Fed should unload Maiden Lane III. (Sober Look, Reuters)

Two big questions for crowdfunding platforms. (Term Sheet)

You have been warned. Harvard Business School has embraced the start-up culture. (Fortune)

Who really ran the first hedge fund: Ben Graham or Alfred Winslow Jones? (Bloomberg)

ETFs

Covered call sector ETFs: thumbs up or thumbs down? (IndexUniverse)

How to avoid bad ETFs. (IndexUniverse)

ETFs that mislead. (Financial Advisor)

Global

How is austerity working out for the UK? (Money Game also Bonddad Blog)

Are high corporate profit margins holding down the recovery? (The Source)

Is Australia kidding itself about its new found prosperity? (FT Alphaville)

Canada’s housing bubble has yet to pop. (Credit Writedowns)

The Arab Spring as JOBS Act. (Term Sheet)

Economy

A look at the April FOMC statement. (Aleph Blog also Economist’s View)

March durable goods drop. (Capital Spectator)

Growth in trucking volume is slowing. (Calafia Beach Pundit, LATimes)

A tale of two recoveries. (Global Macro Monitor also voxEU)

The US manufacturing sector is “robust.” (WSJ)

Our view of career risk and return is changing. (Minyanville)

Why immigration so much for the US. (The Atlantic)

Earlier on Abnormal Returns

Steven Sears, author of The Indomitable Investor, talks about the $VIX vs. Skew and why “Sell in May” works. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Psychology

Think in another language to make better decisions. (Wired)

Store loyalty increases with customer homogeneity. (Science Blog)

How money can buy happiness. (Pragmatic Capitalism)

Mixed media

Why we need an “Everything Drive.” (Slate also WSJ)

If e-books all go DRM-free, what happens to the publishing industry? (Economist’s View)

Abnormal Returns is a founding member of the StockTwits Blog Network.