Quote of the day

John Kemp, “The most important lesson is to treat all economic statistics with appropriate scepticism. Statistics are always subject to some uncertainty, which is why ONS and BEA label them “preliminary estimates”. It is not possible to measure growth to one decimal place — which is why announcements that analysts at XYZ bank have cut their GDP forecast by 0.1 or even 0.2 percent should draw a wry smile.” (FT Alphaville)

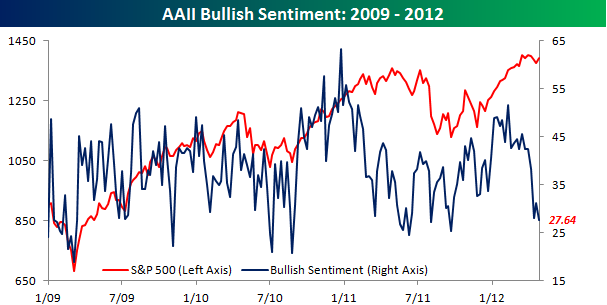

Chart of the day

Where have all the bulls gone? (Bespoke)

Markets

It seems like a lot of pros are underinvested. (Big Picture also Marketblog)

Stocks don’t like the initial claims numbers. (Money Game)

Where did all the muni bonds go? (SmartMoney)

Strategy

Trading rule #2: “You have to have a reason to be in every trade.” (Kid Dynamite)

What to do when you hit your loss limit. (SMB Training)

The unique challenge of Apple to fund managers. (the research puzzle)

Collecting on returns premia is a “lumpy business.” (Systematic Relative Strength)

Research

How to use low volatility funds in a portfolio context. (IndexUniverse)

How to make “fat tails” work for your portfolio. (CSAM via All About Alpha)

Renewed skepticism about betting on commodity indices. (WSJ)

Technology

Amazon ($AMZN) has no “perfect proxy.” (WSJ)

Why was Wall Street surprised by Apple’s ($AAPL) performance? (Asymco)

The future of Apple is in Asia. (AlphaVN)

Will Microsoft’s ($MSFT) new stores turn things around? (Slate)

Are we in a tech (startup) bubble? (Finance Addict)

Finance

Five hedge fund managers who lost their “superstar status.” (Institutional Investor)

Notes from the Booth Distressed Investing and Restructuring Conference. (Distressed Debt Investing)

ETFs

The five best ETF investments ever. (IndexUniverse)

Now the NYSE is set to pay market makers of ETFs. (Focus on Funds)

A closer look at the holdings of the iShares MSCI Spain ETF ($EWP). (Institutional Investor)

More active ETFs from State Street. (ETFdb)

Corporate bond ETFs are getting sliced and diced ever finer. (IndexUniverse)

Global

Three big problems facing Japan. (Bloomberg)

Why is the UK double-dipping? (The Atlantic)

What is China going to do with all that copper? (FT Alphaville)

Meat consumption: China vs. America. (Economist)

Economy

Weekly initial unemployment claims are ticking up. (Calculated Risk, MarketBeat, Capital Spectator)

What CSX ($CSX) and Dow Chemical ($DOW) say about the economy. (Pragmatic Capitalism)

A rave review for Enrico Moretti’s The Geography of Jobs. (EconLog)

Earlier on Abnormal Returns

Steven Sears, author of The Indomitable Investor, talks about how investors should approach the “novel products” Wall Street comes up with. (Abnormal Returns)

Avoiding bad and misleading ETFs. (Abnormal Returns)

What you missed in our Thursday morning linkfest. (Abnormal Returns)

Wealth

What to do if you just made a zillion bucks. (Altucher Confidential)

The shift in global high net worth individuals is not happening as fast as you would think. (Penta)

Venture capital firm Andreesen Horowitz pledges to donate half its future earnings to charity. (Term Sheet)

Mixed media

How tech giants want to re-invent journalism. (paidContent)

When is a scoop non-public information? (Felix Salmon)

Hand crafted curation isn’t dead. David Pell writes “perhaps the world’s best email newsletter. (Pando Daily)

Abnormal Returns is a founding member of the StockTwits Blog Network.