Quote of the day

Joe Fahmy, “Life’s too short and I want to have a smile on my face as much as possible. If you want to stare at your screen and watch EVERY tick of the $SPY on a one-minute chart, go ahead, you have EVERY right to do so. However, in my honest opinion, you will live a miserable, unfulfilled life, and simply become a slave to the stock market.” (Joe Fahmy)

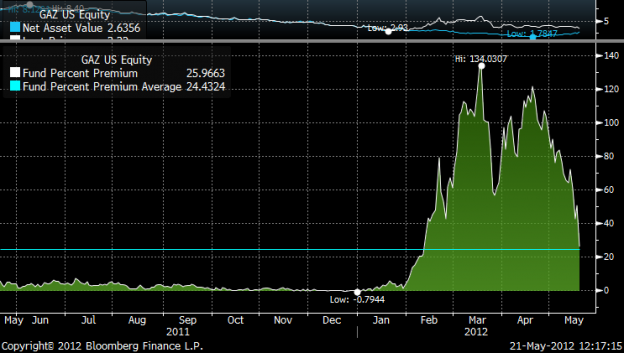

Chart of the day

Seriously people, do not buy iPath DJ-UBS Natural Gas Total Return ETN ($GAZ). (Kid Dynamite)

Markets

Don’t jump the gun…corrections take time to play out. (Chris Perruna)

The equity put-call ratio is elevated. (Horan Capital)

At current yield there is only one way for Treasury bond holders to make money over the long run. (WSJ)

The stock market is looking kinda cheap. (Crossing Wall Street)

The Facebook ($FB) deal was QE in reverse. (Money Game)

Strategy

Don’t get too caught up emotionally in following your trades. (Tyler’s Trading)

Why bad news and higher volatility go hand in hand. (Falkenblog)

Keep single guys as far away from your portfolio as possible. (The Reformed Broker)

How will we look back on 1% active management fees? (Turnkey Analyst)

Companies

Why we should bemoan the rise of the dual class share structures. (James Surowiecki)

What is Facebook worth? (Crossing Wall Street)

American companies are “reshoring” jobs they had previously sent overseas. (FT)

Finance

The parallels between the JP Morgan ($JPM) losses and the AIG ($AIG) debacle. (WashingtonPost)

Jamie Dimon needs to hang a help wanted sign. (Epicurean Dealmaker)

JP Morgan has an excess deposit problem. (Felix Salmon)

Hey peeps, Facebook has been public for awhile now. (Daniel Gross also peHUB)

Trading

Why France churned out so many quants. (Newsweek)

Getco LLC is putting on a more public face. (Crain’s Chicago Business)

Hedge funds

It is hard to make the case for hedge funds based solely on recent performance. (research puzzle pix)

What new positions did hedge funds add in in Q1 2012. (Street of Walls)

Hedge funds are circling European banks looking for cheap, cast off loans. (FT)

Global

China needs dollars. (FT Alphaville)

The run on European banks is due to fears over the value of the Euro. (Gavyn Davies, ibid)

Gold is on sale: Asian consumers say thanks. (AlphaVN also beyondbrics)

Economy

The Chicago Fed National Activity Index is muddling along. (Calculated Risk, Capital Spectator)

US auto sales are too low. (Morningstar also Bonddad Blog)

Rising rents are helping put a floor under house prices. (Sober Look)

House prices look more attractive for those looking for a roof over their heads than they have for a decade. (Pragmatic Capitalism)

How consumers are becoming more efficient. (The Atlantic)

We need more, quality economic data not less. (Calculated Risk, Big Picture)

Earlier on Abnormal Returns

An excerpt from Abnormal Returns: Winning Strategies from the Frontlines of the Investment Blogosphere on what men can learn from women about investing. (FT Alphaville)

Part one of a blog interview with the team at Riskalyze. (Riskalyze)

What you missed in our Monday morning linkfest. (Abnormal Returns)

Book talk

Two reviews of Maneet Ahuja’s The Alpha Masters: Unlocking the Genius of the World’s Top Hedge Funds. (Market Folly, Aleph Blog)

A look at Jonathan Davis and Alasdair Nairn’s Templeton’s Way with Money: Strategies and Philosophy of a Legendary Investor. (Reading the Markets)

Zack Miller talks with Steven Sears author of The Indomitable Investor: Why a Few Succeed in the Stock Market When Everyone Else Fails. (Tradestreaming)

Abnormal Returns is a founding member of the StockTwits Blog Network.