This is an early (and incomplete) version of the daily linkfest. We will hopefully catch up tomorrow.

Quote of the day

Jonathan Adler, “The lesson here is that whether on Wall Street or the strip in Las Vegas, it’s easy to confuse increasing the chances of winning with shifting risk.” (Reuters)

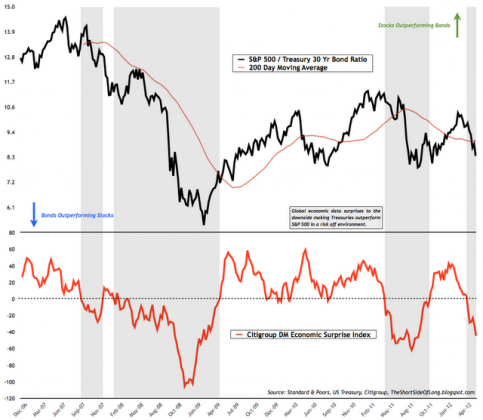

Chart of the day

What’s driving the relative performance of stocks vs. bonds? (The Short Side of Long)

Markets

The TIPS yield curve has inverted. (Sober Look also CBP)

Do you really want to own 10-year Bunds at 1.20%? (WSJ)

What’s the difference between a correction and a bear market? (Dr. Ed’s Blog)

Strategy

At any level of investing: don’t chase. (Howard Lindzon)

Winning by doing nothing. (Systematic Relative Strength)

Why our plans often go right out the window. (Above the Market)

Can individual traders harness the wisdom of crowds and avoid the pitfalls of group think? (All About Alpha)

Companies

Why are companies holding so much cash? (Fortune)

In Silicon Valley there is a real distinction made between consumer and business-focused startups. (Businessweek)

It’s silly time when absurd app ideas are taken seriously. (WSJ)

ETFs

The ETF Deathwatch for June 2012. (Invest With an Edge)

Why the low volatility effect may persist. (iShares Blog)

Global

The list of questions about Europe for which the answer is “Nobody knows” is long. (FT)

Don’t count on Europe to get its act together in time. (Marginal Revolution)

Every one is waiting on Germany to decide who it wants to be when it grows up. (WSJ)

The opportunity in European dividend payers. (Charles Sizemore)

Australian GDP surprises to the upside. (MacroBusiness)

Economy

Handicapping QE3. (WSJ, Tim Duy)

Where the student loan problem is and is not. (Felix Salmon)

Just how sluggish is the housing recovery. (Calculated Risk)

Earlier on Abnormal Returns

Part one of our Q&A on the American economy with Daniel Gross author of Bigger, Stronger, Faster…The Myth of American Decline . . . and the Rise of a New Economy. (Abnormal Returns)

Mixed media

A review of online advice site FutureAdvisor.com. (WSJ)

You are going to hate Windows 8…to start. (Slate)

A review of Airtime. (GigaOM)

In praise of daydreaming. (Frontal Cortex)

Abnormal Returns is a founding member of the StockTwits Blog Network.