Quote of the day

Tim, “Saving the Eurozone is no longer just a matter of money, it’s a question of trust: the question is, is there anyone left that the voters are willing to place their confidence in?” (The Psy-Fi Blog)

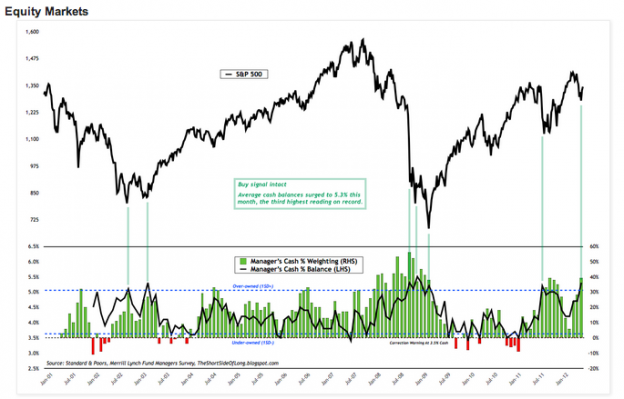

Chart of the day

Equity fund managers are once again holding a big slug of cash. (The Short Side of Long)

Markets

The US continues to outpace the rest of the world. (Bespoke)

Trading the news is not unlike chasing your own tail. (Big Picture)

Why investors have been willing to continue holdings long-term Treasuries. (Sober Look)

Strategy

A good interview with Mike Bellafiore on the proper approach to trading. (Embrace the Trend)

The new way to make money off of Black Swans: predict them. (Falkenblog)

Wealthy investors are still interested in hard assets like timberland and farmland. (Barron’s)

Value investing

A look at four variations on contrarian investing. (Aswath Damodaran)

The case for quantitative value investing. (Greenbackd)

Using stock screens is not as easy as it looks. (Stone Street Advisors)

IPOs

Want to blame some one for the Facebook ($FB) IPO debacle? Blame Morgan Stanley ($MS) they were “driving.” (WSJ)

Workday will be the next big test of the IPO market and the JOBS Act. (Businessweek)

Finance

Consumers refinance mortgages, big banks win. (WSJ)

Are trading algorithms proprietary? (Points and Figures)

Equity risk premium estimates across countries. (CXO Advisory Group)

Defined benefit plan shrinkage is slowing. (Institutional Investor)

ETFs

Why multi-asset ETFs are a hard sell. (Ari Weinberg)

The cheapest ETFs in every category. (ETFdb)

Should investors purchase funds that exclude financials? (Random Roger)

Global

Why change is so slow in coming to Greece. (Money Game)

Europe has a big chicken-or-egg problem. (FT Alphaville)

Bond spreads point to growing fear about Spain relative to Italy. (Sober Look)

Switzerland is no longer in control of its own money supply. (FT Alphaville)

The Australian economy is WAY too dependent on mining. (FT)

Economy

Are we already in recession? (Crossing Wall Street, Capital Spectator)

On the odds of QE3. (Calculated Risk)

Technology

Solar power has gone parabolic. (Gregor Macdonald via FT Alphaville)

“Predictive coding” is now doing the work of high-paid lawyers. (WSJ)

Earlier on Abnormal Returns

What you missed in our Monday morning linkfest. (Abnormal Returns)

On the ever-evolving wall of worry. (Abnormal Returns)

The folly of trying to out think the markets. (Abnormal Returns)

Mixed media

Why advisers can’t ignore social media any more. (InvestmentNews)

How to read the New York Times business section. (Interloper)

The 25 most dangerous financial journalists. (HuffingtonPost)

Top finance people to follow on Twitter. (Market Folly)

Abnormal Returns is a founding member of the StockTwits Blog Network.