Quote of the day

Simon Lack, “You can invest in stocks and not be a stock picker; if you can’t pick hedge funds stay away. ” (In Pursuit of Value)

Chart of the day

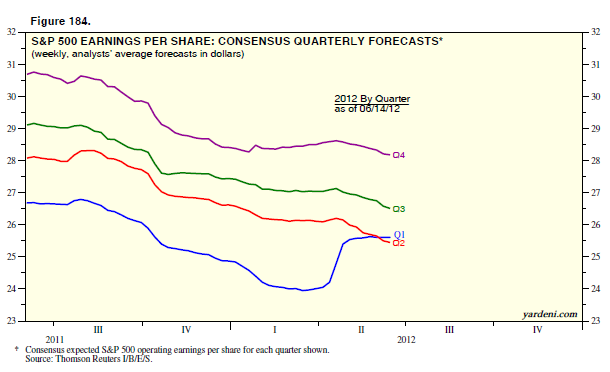

2012 S&P 500 consensus earnings estimates continue to come in. (Dr. Ed’s Blog)

Markets

Paradoxically great things don’t happen when companies are returning cash to shareholders. (EconomPic Data)

Just how much dividend yields tell us about future stock market returns? (Capital Spectator)

Technology stocks now have lower valuations than utilities. (Bespoke)

The really bullish case for gold. (Money Game)

Strategy

The how and whys of building a bond ladder. (A Dash of Insight)

Where are all the young financial planners? (Nerd’s Eye View)

A positive review for Scott Patterson’s Dark Pools: High-Speed Traders, A.I. Bandits, and the Threat to the Global Financial System. (Falkenblog)

Trading

Four investing rules everyone should learn. (Minyanville)

A lot of what we see is not really actionable or “trader porn.” (Trader Habits)

There is a (big) difference between being right and making money. (The Zikomo Letter)

Companies

A look at oil giant Chevron ($CVX). (Turnkey Analyst)

Burger King ($BKW) is public once again. (WSJ)

Technology

Who will be Microsoft’s ($MSFT) Tim Cook? (Asymco)

The case for Apple ($AAPL) straddles. (Tyler’s Trading)

How to build an iPad competitor. (kottke)

Finance

London has become the “center of financial trading disasters” for US banks. (FT)

Looking at the next big IPO: ServiceNow. (Term Sheet, Deal Journal)

Alternatives

Zombie funds are a plague on the private equity landscape. (WSJ)

Julian Robertson on the past and future of hedge funds. (Market Folly)

Real estate

How should institutional investors access real estate? (Institutional Investor)

One very serious investor is jumping on the single family home as investment bandwagon. (Dealbreaker)

ETFs

Why the PowerShares S&P 500 Low Volatility ETF ($SPLV) outperformed of late. (YCharts Blog)

There are more costs to owning an ETF than just the expense ratio. (Morningstar)

Global

Sovereign credit ratings just aren’t all that important. (Felix Salmon)

How much lower oil prices could wreak havoc for countries like Russia. (Foreign Policy)

Economy

The FOMC extends Operation Twist and how the language changed. (Real Time Economics, ibid)

The housing recovery has been uneven, even within towns. (WSJ)

Why is money velocity so low? (Bonddad Blog)

Earlier on Abnormal Returns

A handful of investment-related author interviews worth a look. (Abnormal Returns)

What you missed in our Wednesday morning linkfest. (Abnormal Returns)

Mixed media

Is self-plagarism a big deal? (Slate, Felix Salmon)

Prismatic is looking to put curators out of business. (Pando Daily)

Hyper-local social networks

Babysitting is going high tech. (GigaOM)

Why we need social networks by neighborhood. (Dilbert Blog)

Abnormal Returns is a founding member of the StockTwits Blog Network.